4. Strategy

(1) Recognition of Climate-related Risks and Opportunities

The Group recognizes that climate change issues must be addressed with urgency, but at the same time, sees them as business opportunities. We identify climate-related risks that could be expected to affect business (transition risk/physical risk), and also identify opportunities available through the development and provision of core financial products and services to realize a carbon-neutral society. We set strategies in response to such risks and opportunities, and promote strategic initiatives to enhance climate resilience.

(2) Climate-related Risks

The Group carries out climate-related scenario analysis to identify risks that could be expected to affect businesses.

Examples of the main transition risks include increased costs and resulting deterioration in earnings at investee and managed companies due to changes in carbon pricing policy (policy/legal), increased costs and resulting deterioration in earnings at investee and managed companies due to changes in energy-related technologies (technology), lower value and decreased balance of assets held in the fund from the transition to a carbon-neutral society (market), and deterioration in reputation associated with a lack of initiatives to deal with climate change and investment and underwriting related to businesses with a heavy environmental load (reputation).

Examples of the main physical risks include lost value, reduced sales opportunities, and resulting deterioration in earnings at invested properties such as solar and wind generation facilities due to natural disasters such as torrential rain and powerful typhoons (acute/chronic), as well as business interruption risks including financial system failures or damage to the Group's offices and data centers from more serious natural disasters (acute/chronic).

While recognizing these climate-related risks, we consider the response in light of effects on business and frequency of occurrence, and promote strategies.

The time horizon aligns with the Group's management plan and global standards. Specifically, considering that the period of the Medium-Term Management Plan is three years, "short-term" refers to three years or less, "medium-term" to three to five years, and "long-term" to five years or more.

Examples of Climate-related Risks

| Risk Type | Climate-related Risks | Timeline | Category | Strategic Initiatives | Relevant KPIs | ||

|---|---|---|---|---|---|---|---|

| Transition | Policy / Legal | 01 | Increased costs and resulting deterioration in earnings at investee and managed companies due to changes in carbon pricing policy | Medium to long | Credit risk Operational risk |

|

|

| 02 | Increased costs for the Group associated with response to carbon pricing and mandatory information disclosure, etc. | Short to long | |||||

| Technology | 03 | Increased costs and resulting deterioration in earnings at investee and managed companies due to changes in energy-related technologies | Short to long | ||||

| 04 | Increased costs for the Group with the introduction of new technologies or alternative technologies | Medium to long | |||||

| Market | 05 | Lower value and decreased balance of assets held in the fund from the transition to a carbon-neutral society | Medium to long | Market risk |

|

||

| 06 | A decrease in value and divestment opportunities of carbonintensive assets due to economic or industry stagnation or contraction or fluctuations in the financial market | Short to long | |||||

| Reputation | 07 | Deterioration of reputation associated with a lack of initiatives to deal with climate change and investment and underwriting related to businesses with a heavy environmental load | Short to long | Reputational risk |

|

||

| Physical | Acute / Chronic | 08 | Increased recovery costs for transaction partners or investee and managed companies due to abnormal weather or wind and flood damage and the resulting lower value and decreased balance of the assets held in the fund | Medium to long | Credit risk Market risk |

|

|

| 09 | Lost value, reduced sales opportunities, and resulting deterioration in earnings at invested properties such as solar and wind generation facilities due to natural disasters such as torrential rain and powerful typhoons | Short to long | |||||

| 10 | Increased health problems among customers and labor restrictions due to abnormally high temperatures and abnormal weather and resulting reduced earnings opportunities | Short to long | |||||

| 11 | Increased health hazards and constraints on employment for the Group's officers and employees due to abnormal weather and the consequent deterioration in earnings | Medium to long | Operational risk | Formulation of disaster mitigation measures and BCP | - | ||

| 12 | Business interruption risks including financial system failures or damage to the Group's offices and data centers from more serious natural disasters | Short to long | |||||

- *For initiatives ① to ⑦, please refer to "4. Strategy (5) Climate-related Strategies"

(3) Resilience Assessment of Our Strategy Based on Climate-related Risks

The Group recognizes effects arising from climate-related risks, and carries out a scenario analysis, referencing IFRS S2*1, to assess its resilience to climate-related changes, developments or uncertainties.

We assess transition risks using NGFS climate scenarios*2 to estimate potential losses on carbon-intensive assets. For physical risks, we reference IPCC scenarios*3 to estimate potential damage from natural disasters to owned real estate in May 2024 and renewable energy facilities in May 2025.

The results, along with strategic responses, are discussed by the Sustainability Committee and reported to the Executive Management Committee. The following are the details of the scenarios and the assumptions used in analysis.

- *1IFRS S2 Paragraph 22 and Appendix B1 to B18 (2023)

- *2Scenarios for evaluating financial system impacts developed by the NGFS (Network for Greening the Financial System), a global network of central banks and financial regulators.

- *3 GHG Emission Scenarios Published by IPCC (the Intergovernmental Panel on Climate Change)

Scenario Analysis Assumptions

| Items | (a) Qualitative Analysis | Quantitative Analysis | |||

|---|---|---|---|---|---|

| (b) Transition Risks | (c) Physical Risks | ||||

| Scenarios | Variables used in NGFS climate scenarios |

NGFS climate scenario: Net Zero 2050/Delayed Transition/Fragmented World/Current policies |

IPCC climate scenario: RCP8.5/RCP4.5 |

IPCC-adopted climate scenarios developed by the international community: SSP5-8.5 / SSP1-2.6 |

|

| Scope of Analysis | Impact of Transition and Physical Risks on the Group |

Transition risk (effects on financial markets due to changes in policies, regulations, supply and demand conditions)

|

Transition risk (effects on financial markets due to changes in policies, regulations, supply and demand conditions)

|

Physical risk/Acute (storm and flood damage)

|

Physical risk/Acute (storm and flood damage)

|

| Target Period | From 2025 to 2050 (26 years) |

From 2025 to 2050 (26 years) |

From 2025 to 2029 (5 years) |

From 2024 to 2050 (27 years) |

From 2025 to 2050 (26 years) |

| Analysis Timing | May 2025 | May 2025 | May 2025 | May 2024 | May 2025 (new) |

Envisioned Scenarios

| (i) Orderly | (ii) Disorderly | (iii) Too Little, Too Late | (iv) Hot House World | ||

|---|---|---|---|---|---|

| NGFS Climate Scenario | Net Zero 2050 | Delayed Transition | Fragmented World | Current Policies | |

| Scenario Overview | Through a strict emissions reduction policy and innovation, limit the rise in temperature to below 1.5°C, and target net zero global GHG emissions in 2050. | Virtually no reduction in emissions by 2030. Powerful policies are required to limit the rise in temperature to 2°C. CO2 removal is limited. | Virtually no reduction in emissions by 2030, and policies thereafter are also out of step and inadequate. Unable to suppress rises in temperature. | Envision retention of only the policies currently being implemented. Increased physical risk. | |

| Assumptions | Introduce Policies | Promptly and smoothly | Delayed | Delayed and inadequate | With the current policies |

| Macro-economic Trends | Comparatively small decline in GDP | Comparatively large decline in GDP | Comparatively large decline in GDP | Comparatively large decline in GDP | |

| Energy Use | Comparatively large decline | Comparatively large decline (From 2030s) | Comparatively large decline (From 2030s) | Comparatively large increase | |

| Technological Change | Quick | Slow/Quick | Slow/Inadequate | Slow | |

| Impact of Climate Change | Rise in Temperature (2050) | Approx. 1.5°C | Approx. 1.5°C | Approx. 2.5°C | Approx. 3°C |

| CO2 Emissions | Reduction (steady) | Reduction (headwinds present) | Reduction (inadequate) | Maintain current pace of reduction | |

| National- or Regional-level Variables | Primarily limited to domestic factors | Primarily limited to domestic factors | Primarily limited to domestic factors | Primarily limited to domestic factors | |

| Risks | Transition Risk | ★★★ | ★★☆ | ★★☆ | ★☆☆ |

| Physical Risk | ★☆☆ | ★★☆ | ★★★ | ★★★ | |

| Opportunities | ★★★ | ★★☆ | ★★☆ | ★☆☆ | |

- *Created based on NGFS Climate Scenarios Phase V

① Analysis Results

(a) Effects on Business Activities

Shutdowns or slowdowns in the economy or industry, volatility in the financial markets (falling stock prices, increased credit risk, etc.), damage from heavy rains or flooding, and health problems caused by abnormally high temperatures were all listed as factors of relative concern. When applied to scenarios, transition risks could appear as (ii) Disorderly and (iii) Too Little, Too Late in cases where CO2 emission reductions lead to economic or social turmoil, and physical risks could appear as (iv) Hot House World in cases where CO2 emission reductions are delayed.

On the other hand, the energy transition has a negative effect on existing businesses from the reduction of fossil fuel resources and a positive effect on new business opportunities with the increase in new forms of energy, such as renewable energy. This means that, overall, the energy transition is positioned as a near neutral factor. We forecast change in the impact corresponding to the burden such as the costs associated with transition and taxes. Furthermore, climate change initiatives such as CO2 emission reductions could affect corporate reputation, which in turn affect the overall business indirectly.

In this way, the Group is thought to have a certain level of climate resilience as a result of having comprehensively considered the positive and negative impacts on the business from social and economic elements that are strongly related to climate phenomena, such as energy transition. Furthermore, to mitigate the negative effect, we have formulated disaster mitigation measures against the risks of direct damage from heavy rains or flooding and a business continuity plan (BCP) while we believe it is possible to curb the negative effect even if the macro economy stagnates by steadily implementing climate change initiatives and maintaining our reputation.

(b) Effects on Carbon-intensive Assets

The cumulative losses amounted to approximately 67.1 billion yen under (iv) Hot House World for non-trading assets through 2050, and 350 million yen for trading assets through 2029, both relative to the base scenario*.

The estimates were calculated using figures from the Group's consolidated financial statements for the fiscal year ending December 2024.

Based on the results, the short-term impact of climate-related risks and opportunities, including the current and next fiscal years, on our financial soundness is limited. We will continue to refine our analysis and aim to reduce exposure to high-impact carbon-intensive assets over the medium to long term. In addition, we recognize that reducing carbon-intensive assets requires broader societal efforts, and we actively engage in domestic and international initiatives to support decarbonization.

- *The estimation was based on an adjusted short-term scenario, referencing (ii) Disorderly Transition from the NGFS Climate Scenarios Phase V (November 2024).

(c) Effects on Our Properties

Due to the increase in weather events arise from climate change, the real estate-related exposures and our non-operational real estate, which constitute a significant portion of our strategy, are likely to be affected. Scenario analysis indicates that under the RCP8.5 scenario, which assumes the highest temperature increase, the average annual estimated damage from storm and flood disasters is approximately 40 million yen in 2030 and 50 million yen in 2050. Our real estate is largely located in areas less susceptible to storm and flood damage and consists mainly of robust structures and high-rise properties. Therefore, the effects on the Group are likely to be limited.

In addition, as the transition progresses, physical risks are also expected for renewable energy facilities. Under the SSP5-8.5 scenario, the estimated average annual loss in 2050 was approximately 40 million yen. The analysis revealed that risks are concentrated in specific facilities located in mountainous areas, which are more vulnerable to storm and flood damage. Nevertheless, the overall financial impact remains limited.

The estimates were calculated using figures from the Group's consolidated financial statements for the fiscal year ending December 2024.

② Future Response

In the current scenario analysis, we have formulated hypotheses based on the information and data presently available and narrowed down the scope of analysis. For example, the scope of analysis is mainly focused on Japan, where the majority of climate-related risks and opportunities are concentrated, due to the nature of our business. The scope of climate-related risks is very broad, and multiple patterns can be envisioned for the periods of occurrence and scale of risks, due to rapid changes in the financial markets (stock prices, credit risks, etc.), policies and laws, and the evaluation of ESG responses. We will acquire a broader range of information and related data and improve the method of analysis to assess effects on the financial position, financial performance and cash flows over the medium and long term, thereby increasing our climate resilience.

We strengthen stakeholder engagement on risks such as policy, legal, market, and technological changes, promote sustainable finance, and enhance BCP measures against physical risks to improve climate resilience. For details, please refer to "4. Strategy (5) Climate-related Strategies".

(4) Climate-related Opportunities

Taking account of the effects assessed through scenario analysis after consultation with each business division, the Group identifies climate-related risks and opportunities and assesses their importance.

Examples of main opportunities include increase in underwriting to raise funds needed for green projects and the transition to a carbon-neutral society (Global Markets & Investment Banking Division), increase in opportunities to provide new financial products and increase in opportunities to profit from market changes (Wealth Management Division), expansion in opportunities for investing in new industries and companies that contribute to the transition to a carbon-neutral society (Asset Management Division), and stimulation of the entire market through participation in sustainability-related rule-making (the entire Group).

In addition to responding to climate-related risks, these climate-related opportunities are reported as needed to the Board of Directors following discussion at either the Sustainability Promotion Committee or the Executive Management Committee.

Examples of Climate-related Opportunities

| Business Segment | Climate-related Opportunities | Timeline | Strategic Initiatives | Relevant KPIs |

|---|---|---|---|---|

| Global Markets & Investment Banking Division | Increased underwriting for the fundraising required for green projects and the transition to a carbon-neutral society | Short to long |

|

|

| Increased M&A in the renewable energy field | Short to long | |||

| Wealth Management Division Asset Management Division |

Increased opportunities to provide new financial products and expansion of opportunities for profit through market change | Short to long |

|

|

| Capital inflows into investment trusts that incorporate companies with decarbonization technologies | Short to long | |||

| Investment into renewable energy such as solar power generation facilities and greater investment opportunities through the introduction of external capital | Short to long |

|

||

| Greater investment opportunities into new industries and companies that contribute to the transition to a carbon-neutral society | Short to long | |||

| Structuring and managing investment corporations and private funds with underlying assets that are real estate and real assets with high environmental performance | Short to long | |||

| Others | Greater opportunities for solution businesses that support the transition to a carbon-neutral society | Short to long | - | |

| The entire Group | Expansion in business opportunities resulting from improvement in reputation through net-zero initiatives | Short to long |

|

|

| Support the transition to a carbon-neutral society and response to climate change through engagement with issuers and investors, etc. | Short to long | - | ||

| Stimulation of the entire market through participation sustainability-related rule-making | Short to long | - |

(5) Climate-related Strategies

The Group promotes strategies in response to climate-related risks and opportunities identified in each division.

We will promote the following strategies from ① to ⑧ to respond to transition risks and opportunities. To respond to physical risk, we have formulated a BCP in anticipation of the case where the head office (the Group's headquarters functions), branches, data centers are unable to function due to damage caused when social infrastructure is shut down because of abnormal weather or wind and flood damage.

- ①Promoting sustainable finance

- ②Enhancing M&A advisory in the sustainability field

- ③Development of products and services, and promotion of investment and lending focused on sustainability

- ④Sourcing and investment focused on sustainability

- ⑤Providing sustainability-related solutions

- ⑥Realizing carbon neutrality within our own operations

- ⑦Strengthening engagement with stakeholders

- ⑧Involvement in rule making

We are also promoting human resource development such as the implementation of training to improve expertise related to sustainability including climate change for officers and employees. Specifically, since 2022, we have conducted annual Vision training for all officers and employees aimed at improving their sustainability-related knowledge and awareness, and further enhancing the "Take it as your own matter" mindset. Furthermore, in FY2024, 284 employees and executives participated in the GX Introductory Course and GX Basic Certification offered by Skill-Up NeXt, as part of our efforts to support clients in sustainability and GX.

ESG Certification at Daiwa Asset Management

In 2024, Daiwa Asset Management introduced an internal certification title for ESG personnel, recognizing employees with a certain level of expertise in stewardship, ESG, and sustainability initiatives.

Sustainability Associate

To earn certification, employees are required to complete an external ESG and SDGs course and pass an internal exam developed by the Responsible Investment Department.

The certification is open to managerial-level staff on a voluntary basis. In 2024, 39 employees were certified.

Sustainability Leader

Employees who have earned the Sustainability Associate Certificate may apply internally to participate in a three-month training program led by the Responsible Investment Department. The curriculum includes lectures on stewardship, ESG, and sustainability, as well as practical experience such as attending engagement meetings and proxy voting exercises. Participants also gain timely and specialized insights through meetings with external ESG analysts. In 2024, 15 employees from 11 departments completed the program and are now applying their knowledge to advance sustainability within their respective teams.

① Promoting sustainable finance

Since the adoption of the Paris Agreement in 2015, decarbonization initiatives have accelerated throughout the world. The Group is actively engaged in sustainable finance as a core business to support initiatives for global decarbonization.

While support for fundraising had previously been the core business, we also see the incorporation of SDGs elements as new business opportunities that increase added value that we can provide to customers. In FY2022, we contributed to market expansion through our work as bookrunner and SA* for large-scale bond issuances, including FUJIFILM Holdings' four-tranche social bond, the largest ever made on the Japanese public bond market, and NEC's three-tranche sustainability-linked bond, the first of its kind to be publicly offered in Japan. In FY2023, we have been promoting product diversification by serving as lead manager for Kao's coupon step-up sustainability-linked bond and the Republic of Indonesia's samurai bond, the world's first samurai blue bond.

In 2024, we were entrusted as an SA with the task of formulating a framework for the climate transition interest-bearing bonds issued by the Japanese Government, thereby facilitating transition finance in Japan and abroad. Moreover, we participate in bidding for these bonds as a primary dealer, and contribute in a way that promotes the stable consumption of bonds, which in turn maintains and improves market liquidity.

The Group has also set the SDG bond league table as our sustainability KPI and is monitoring it regularly. In FY2024, Our total green bond underwriting volume reached 647.8 billion yen, and we ranked 1st in both the SDGs bond league table and the GX Transition Bond Primary Dealer Bid Ranking. We will continue to support the transition strategies of the Japanese Government from various angles.

In addition, during 2024, we focused on further enhancing sustainable finance through its involvement in transition bonds issued by the Development Bank of Japan, a first for a financial institution in Japan, as well as in blue bonds for Mitsui O.S.K. Lines based in part on international guidance, a world-first as part of the shipping industry.

We issued its own green bond through a domestic public offering, based on the Green Finance Framework we established and disclosed on January 31, 2024. The proceeds of the continual issuance were allocated toward the redemption of bonds related to investment and lending for Renewable Energy Power Generation Project through consolidated subsidiaries.

Green Bond Issuance

November 2018: Total issuance of 10 billion yen

February 2024: Total issuance of 10 billion yen

- *As of March 31, 2025

Main SDGs bonds underwriting

| FY | Issuer | Type of Issue | Issue Amount |

|---|---|---|---|

| 2022 | FUJIFILM Holdings | Social bonds (Bookrunner, SA) | Total 120.0 billion yen |

| NEC | Sustainability-linked bonds (Bookrunner, SA) | Total 110.0 billion yen | |

| KDDI | Sustainability bonds (Bookrunner, SA) | Total 100.0 billion yen | |

| 2023 | Republic of Indonesia | Samurai blue bonds (Lead manager) | 20.7 billion yen |

| Kao | Sustainability-linked bonds (Bookrunner, SA) | 25.0 billion yen | |

| Japan Airlines | Transition bonds (Bookrunner) | 20.0 billion yen | |

| 2024 | Japanese Government | Climate transition interest-bearing bonds (Contracted business*) | - |

| Mitsui O.S.K. Lines | Blue bonds (Bookrunner, SA) | 20.0 billion yen | |

| Central Nippon Expressway | Green bonds (Bookrunner, SA) | 60.0 billion yen | |

| Development Bank of Japan | Transition bonds (Bookrunner, SA) | 10.0 billion yen |

- *Contracted under the FY2023 Promoting Structural Transition Based on Decarbonization Measure Survey Project (survey regarding use of green transition bonds, etc.

② Enhancing M&A advisory in the sustainability field

The Group is also strengthening M&A advisory services in the renewable energy sector through tie-ups with major European companies that are leading in this field. Specifically, we are accelerating our business development through a capital and business alliance with Green Giraffe, which runs a financial advisory business specialized for this field.

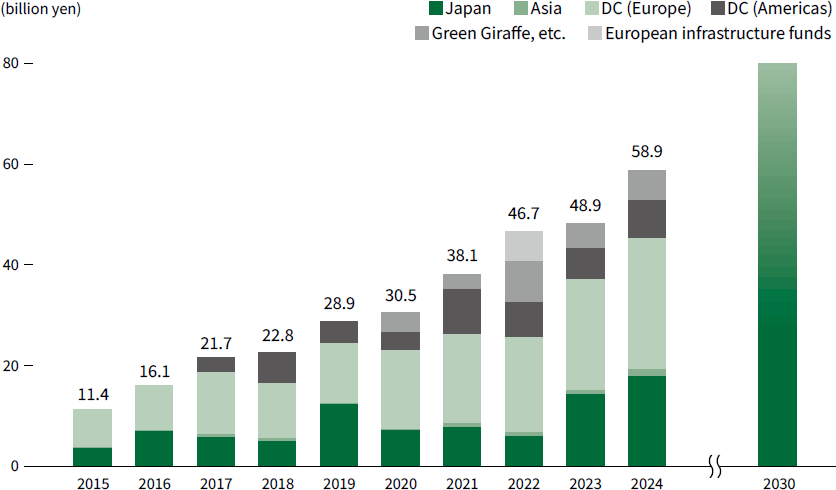

The overseas M&A business continues to grow steadily, with related revenue reaching 58.9 billion yen in FY2024. Looking ahead to FY2030, we aim to exceed 70 billion yen in revenue while expanding our global workforce from 700 to 900 employees.

Trend in M&A-related Revenues

③ Development of products and services, and promotion of investment and lending focused on sustainability

The Group is strengthening development of products and services, and investment and lending focused on sustainability. Daiwa Asset Management provides investment trusts comprised of companies with initiatives to achieve ESG and SDG goals toward the transition to sustainable society. The "Decarbonization Technology Fund" (nickname: Carbon ZERO), with total net assets of 22.1 billion yen, is one of its core offerings.

A portion of its trust fees is donated to a tree-planting project led by the NPO Environmental Relations Research Institute. Trees are planted annually between May and June by local forestry cooperatives and are maintained for ten years. In 2024, 5,425 trees were planted across three locations, bringing the cumulative total to 21,529 trees across six regions in Japan.

The company won the Green Finance Governor's Special Award in the ESG Investment subcategory at the Tokyo Financial Award 2021, as well as the Chairman's Award (Bronze) at the 5th ESG Finance Awards Japan. In addition, Candriam, which provided the company with investment advice, was ranked No.1 out of approximately 600 asset management companies around the world in Switzerland's Herschel & Kramer Responsible Investment Brand Index 2023.

- *As of March 31, 2025

Investment Objectives of the Decarbonization Technology Fund

- 1.Focus on climate change mitigation technologies

Of the climate change countermeasures that will contribute to achieving decarbonization in 2050, we will selectively invest in companies that possess cutting-edge technologies for critical mitigation measures. - 2.Adoption of a carbon offset system

Calculating the carbon emissions of investee companies on a monthly basis, it uses a carbon offset mechanism to achieve net zero across the fund, thereby contributing to the carbon zero goal. Together with other supporting sales companies, including Daiwa Securities, we donate a portion of our trust fees to the "Forest for tomorrow, fostered together" tree-planting project. - 3.Meet strict sustainable finance disclosure standards

It is categorized as a "dark green" fund in meeting the strict standards of Article 9 of the EU's Sustainable Finance Disclosure Regulation (SFDR). According to a report by Morningstar, even in Europe the number of applicable funds is limited to 4%*.

- *Morningstar Direct (as of December 31, 2022)

In March 2024, we have introduced ESG and SDGs analysis in the "Daiwa Future Designer" asset management planning tool.

ESG and SDGs Analysis in the Daiwa Future Designer

As global awareness of sustainability issues such as climate change and social inequality continues to grow, institutional investors, including financial institutions, incorporate sustainability data, such as ESG ratings, into their investment decisions to enhance performance.

Our ESG and SDGs analysis service, powered by MSCI, is the first of its kind in Japan to utilize the WealthBenchTM portfolio risk analysis solution. It uses MSCI ESG Ratings to assess companies' sustainability efforts, evaluates company's initiatives across the 17 goals, and estimates portfolio emissions to assess its alignment with the global 2°C target (with an aspirational goal of 1.5°C) under the Paris Agreement*. This enables investors to factor in corporate sustainability when selecting investments, with the potential to improve medium- to long-term portfolio performance.

- *The Paris Agreement aims to limit global warming to 2°C, with efforts toward 1.5°C. MSCI's ITR metric assesses portfolio alignment with the 1.5°C target.

- *A service developed for the Japanese market based on MSCI's WealthBenchTM portfolio risk analysis solution, supporting clients from portfolio analysis and investment decision-making to ongoing monitoring.

④ Sourcing and investment focused on sustainability

The Group promotes sourcing and investment focused on sustainability, particularly in the renewable energy field. Daiwa Energy & Infrastructure was established in July 2018 and took over the control of the energy investment function that had been undertaken by Daiwa PI Partners. Investments were previously made into the domestic renewable energy sector focused on solar power generation, but now the investment fields have been expanded to overseas renewable energy and infrastructure.

In FY2023, we acquired a stake in Aurora Infrastructure, which operates a power distribution business for the industrial sector in Finland, and secured multiple solar power projects in Australia through a partnership with ENECHANGE. We also incorporated CO2OS to strengthen solar facility development, assessment, maintenance and asset management, and invested in a battery storage facility in west Sapporo.

In FY2024, we co-invested in U.S. onshore wind and solar projects, expanded battery storage investments across Japan, the U.S., and Europe, and began investing in domestic data center infrastructure.

Furthermore, Daiwa Real Estate Asset Management provides investment opportunities for alternative assets such as ESG-friendly real estate. Daiwa Office Investment Corporation and Daiwa Securities Living Investment Corporation, to which Daiwa Real Estate Asset Management has entrusted asset management, are working to expand the supply of high environmental performance office buildings and superior, high-quality healthcare facilities by investing with funds raised from sustainable finance. It has also been entrusted with the management of solar power plants and biomass power plants, and has commenced management operations of the DSREF Amaterasu Core Fund, Investment Limited Partnership, a private placement fund established in September 2021 with the intent of investing in solar power projects by soliciting funding from institutional investors in Japan.

Renewable Energy Power Plant Asset Management Track-record

Number of deals: 31 (Hokkaido, Tohoku, Hokuriku, Kanto, Chubu, Kansai, Chugoku, and Shikoku regions)

Output: Solar power plants approx. 294MW (excluding output from assets on land with leasehold interest)

Biomass power plants approx. 20MW

Balance of assets under management: approx. 108.7 billion yen

- *As of March 31, 2025

⑤ Providing sustainability-related solutions

In the research and consulting business of Daiwa Institute of Research, we are strengthening sustainability-related solutions.

We offer information and policy proposals on the effects of climate change on the economy and society and strengthen our consulting to establish management strategies and support projects to address climate-related risks including response to climate change, as we connect our efforts to enhancing our customers' corporate value.

⑥ Realizing carbon neutrality within our own operations

We formulated the Net Zero Carbon Declaration and are advancing efforts to realize carbon neutrality. For details, please refer to "4. Strategy (6) Transition Plan to Realize Carbon Neutrality".

⑦ Strengthening engagement with stakeholders

The Group strengthens engagement with our shareholders including issuers and investors to help our customers' transition to decarbonization. For example, based on the Environmental and Social Policy Framework, in recognition of risks relating to our businesses that could have a significant negative impacts on the environment or society, we are advancing the appropriate policies through engagement with investees and lenders.

In addition, Daiwa Asset Management positions climate change as one issue of materiality and we conduct engagements with investee companies. The company has defined a vision for best-practice management to support sustainable corporate value growth and promotes its adoption through engagement activities. In 2024, 1,384 engagements were conducted, with 22.6% focused on ESG themes*.

- *Discussing multiple themes in a single meeting

Best Practice (Climate Change)

- By formulating and analyzing climate change scenarios in line with the TCFD framework, the company identifies transitional risks, physical risks and business opportunities.

- The company implements quantitative monitoring of greenhouse gas emissions, emissions per unit of production, and the anticipated risks and opportunities.

- The company formulates a concrete roadmap and milestones for achieving carbon neutrality by 2050, and explains the progress made on an annual basis. It is also desirable that the company should set a goal of reducing emissions by at least 50% by 2030, in line with Daiwa AM's NZAMi* intermediate goals.

- The company formulates and implements a business strategy that takes both risks and opportunities into account, and implements the summarizing and evaluation of activity implementation status.

- *Net Zero Asset Managers initiative

⑧ Involvement in rule making

The Group actively participates in various discussion forums and initiatives, both domestically and overseas in order to contribute to the realization of a sustainable society.

In recent years, amid progress in initiatives towards the formulation of sustainability disclosure standards, the Group's officers and employees have taken on active roles as a trustee of the IFRS Foundation, which includes the ISSB under its governance, and as a member of the Sustainability Standards Board of Japan (SSBJ), which formulates domestic sustainability disclosure standards. In addition, we contribute to various rule making through participation in the Partnership for Carbon Accounting Financials, which develops methods for measuring and disclosing GHG emissions through investment and loans and the GX League.

Daiwa Securities participated as a market maker in the Tokyo Stock Exchange's carbon credit market and was recognized as a "Good Market Maker" in FY2023 and FY2024 for contributing to liquidity and fair pricing in the renewable energy category.

(6) Transition Plan to Realize Carbon Neutrality

① Net Zero GHG Emissions within Our Own Operations by FY2030 (Scope 1 and Scope 2)

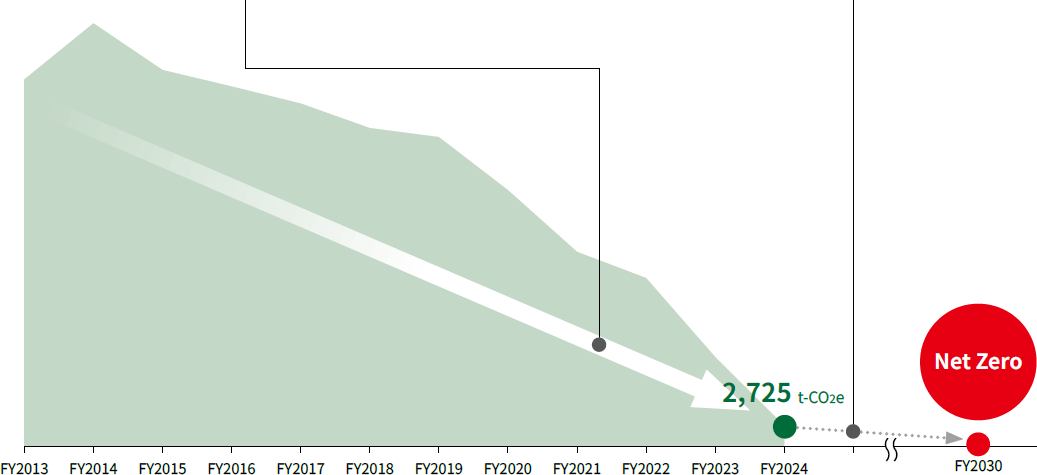

We promote to realize net zero GHG emissions within our own operations (Scope 1 and Scope 2) towards becoming carbon neutral by FY2030.

The trend in Scope 1 and Scope 2 is as follows. In terms of our specific initiatives, we will promote continuing our energy saving activities as well as shifting to renewable energy for electricity consumption.

We are currently implementing energy-saving technologies and systems at each office, improving energy efficiency, and will continue these efforts going forward.

Since April 2021, all group companies located in the headquarters have been using renewable energy by utilizing tracked non-fossil certificates. In January 2024, Daiwa Securities switched all domestic offices to renewable energy, followed by Daiwa Institute of Research in April 2024. We have set interim domestic targets for 2025 (Scope 1: 416t, Scope 2: 55t), which have been submitted to the GX League.

To achieve these targets, we will continue transitioning overseas offices to renewable energy and consider carbon credits for emissions that are difficult to reduce internally. We also use internal carbon pricing when selecting renewable electricity plans, comparing projected costs based on J-Credit prices* with additional costs, using GHG reduction data from power providers.

- *3,246 yen/t-CO2 in FY2024

Past Initiatives

- Energy efficiency improvements

- Equipment upgrades (e.g., air conditioning, LED)

- Operational optimization

- Switching to renewable energy using tracked non-fossil certificates

- Switching all domestic offices of Daiwa Securities and Daiwa Institute of Research to renewable electricity

Future Initiatives

- Continued efforts to improve energy efficiency

- Exploring renewable energy adoption at overseas offices

- Utilizing carbon offsets

- Purchasing carbon credits such as J-Credits

- *1GHG emissions are calculated based on approximately 93% of employee-based locations.

- *2FY2024 results are presented using the market-based method. For location-based data, please refer to "6. Metrics and Targets (2) GHG Emissions (Scope 1 and Scope 2 and Scope 3)".

② Net Zero GHG Emissions within Our Investment and Loan Portfolios, etc. by 2050 (Scope 3)

Toward the realization of a carbon-neutral society, companies are required to manage and reduce GHG emissions emitted not only from their own companies but also their entire supply chains. Financial institutions are particularly expected to manage Scope 3 Category 15 emissions, including financed emissions and facilitated emissions.

Financed Emissions

To reduce financed emissions, we are taking action in line with the following process.

Process of Reducing Financed Emissions

- Select preferred

asset classes and

sectors - Analyze sector

characteristics

and collection of

data - Examine

methods for

measuring and

managing - Set and disclose

intermediate

targets using SBT,

etc. - Formulate strategies

and promote

engagement

The Group joined PCAF and the PCAF Japan coalition in December 2021, and measures GHG emissions while utilizing PCAF's knowledge and database. For FY2023 results, the scope of measurement was expanded compared to previous fiscal years and was not limited to high-emitting sectors. In addition to Scope 1 and Scope 2, Scope 3 emissions were also measured for investees and lenders. In FY2023, we set interim targets for FY2030 targets for project finance in the power generation sector, which accounts for the largest proportion of emissions in our own investment and loan portfolios. Please refer to "6. Metrics and Targets" for details.

Facilitated Emissions

We are closely monitoring international developments regarding facilitated emissions and are coordinating with relevant departments to begin estimating them. In addition, Daiwa Securities actively promotes transition finance to support a decarbonized society and will continue to strengthen these efforts.

③ Supporting the Smooth Transition to a Carbon-neutral Society through Our Business Activities

As an integrated securities group, through our financial business, we will continue to support our customers' efforts toward decarbonization.

Please refer to "4. Strategy (5) Climate-related Strategies" for details.