Role and Social Responsibilities of the Securities Business

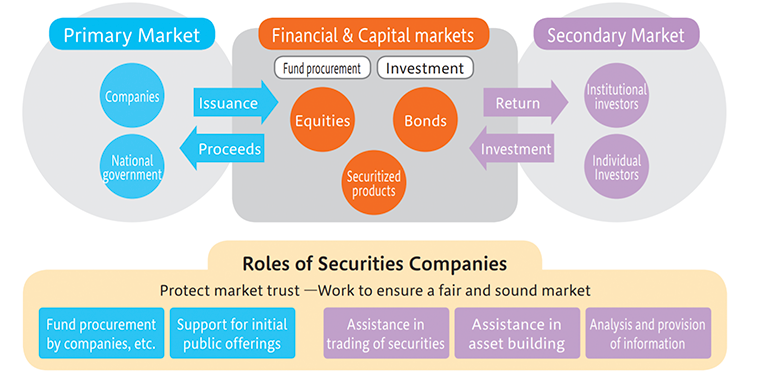

At Daiwa Securities Group, we believe that our role is not only to maintain and develop a fair and dynamic financial market, but also to incorporate a social perspective in finance in order to contribute to building a sustainable society. For example, the securities business - our core operations - plays a key role in society by building a bridge between the needs of investors to manage assets and those of the private and public sectors to raise funds.

On investing in securities, we promote methods of investment that take ESG (environment, society, and governance) factors and the social impacts of the investment into account together with financial information.

Supporting Sound Financial and Capital Markets

-Six Roles of the Daiwa Securities Group-

We support companies that need funds, from listing support to consulting. We will continue to support social infrastructure by creating a flow of funds, contributing to the creation of an environment in which innovation is easy to occur, and the creation of a more active and stable financial market.

- Role 1: Fund procurement by companies, etc.

- Role 2: Support for initial public offerings

- Role 3: Assistance in trading of securities

- Role 4: Assistance in asset building

- Role 5: Analysis and provision of information

- Role 6: Protect market trust

Initiatives for Maintaining Market Functions

Role and Importance of Settlement Functions

Securities settlement - a mainstay of the Group's overall operations - is the delivery of stocks, bonds, or other instruments and funds both to and from the buyer and seller of a securities transaction. Settlement functions also serve as a social infrastructure, and therefore security, reliability, and convenience are important. In secure and trusted markets, financial instruments can be reliably converted into cash when necessary. This is the very reason why such markets attract investment money from all over the world and enable companies and others with funding needs to procure funds.

Responsibility as a Securities Company

Any delay in settlement functions could lead to a loss of trust in the market as a whole, which in turn could have a significant impact on the global economy. Daiwa Securities considers it vital to settle transactions accurately and promptly as required in order to ensure that markets function as a social infrastructure and become a driver for economic development. It is therefore continually striving to build the best structure for ensuring the smooth execution of settlement operations.

For this reason, Daiwa Securities has implemented a reliable system that has high processing capability to reliably settle a massive number of transactions. In addition, the company is carrying out its settlement operations by assigning to the position personnel with a wide range of knowledge and expertise to quickly grasp the situation and respond appropriately in the event of an irregularity.

Also, in order to continue its settlement operations for the maintenance of the financial system even in the event of contingencies such as natural disasters, Daiwa Securities is working to enhance its operational resilience.

The reliability of settlement is extremely important for maintaining customer trust. We will continue to meet increasingly sophisticated customer needs and quickly provide solutions by taking advantage of our reliable settlement infrastructure and human resources.

Responsible Action as an Institutional Investor

Adoption of "Japan's Stewardship Code"

The Financial Services Agency of Japan published "Principles for Responsible Institutional Investors (Japan's Stewardship Code)" in February 2014. The Code, which has been revised three times, encourages institutional investors to fulfill their responsibilities of enhancing the medium- to long-term investment returns for their clients and beneficiaries by improving and fostering the investee companies' corporate value and sustainable growth through constructive engagement, or purposeful dialogue, based on consideration of medium- to long-term sustainability including ESG factors consistent with their investment management strategies.

In our Group, Daiwa Securities and Daiwa Asset Management have announced their adoption of the Code.

Adoption of Principles for Responsible Institutional Investors (Japan's Stewardship Code)

System at Daiwa Asset Management

Daiwa Asset Management became a signatory to the United Nations-supported Principles for Responsible Investment (PRI) in May 2006. It takes into account ESG initiatives taken by companies when making investment decisions, as it considers that such initiatives can lead to expanding growth capabilities over the medium to long term and reducing risks. Moreover, Daiwa Asset Management published its "ESG Investment Policy" in January 2020 to clarify its approach to ESG. In principle, the Policy applies to all investment strategies of the company.

After announcing its adoption of Japan's Stewardship Code in May 2014, Daiwa Asset Management renewed the announcement of its adoption of the Code in September 2020 in line with the revision of the code, and has since been continuously and actively fulfilling its stewardship responsibilities and striving to improve its initiatives. The company's basic approach to stewardship activities is shown in its Stewardship Policy. Details of its stewardship activities, including status of engagement (such as policy, structure, and a breakdown of activities by category), are released annually in its Stewardship Report. The report's name has been changed to Sustainability Report starting from the April 2023 issue. In addition to the existing contents, the report introduces the sustainability-oriented management that we are working on as a corporation.

Sustainability-Related Education, Training and Exchange of Information

Daiwa Asset Management has adopted "Enhance Global Sustainability" as part of its action guidelines, and is taking systematic measures that will contribute to the sustainable growth of society.

Education and Training for Executives and Employees

Daiwa Asset Management provides all executives and employees with internal training designed to share knowledge of stewardship activities that should be undertaken by an asset management company as well as overall knowledge of sustainability. As sustainability, in particular, is a field where new initiatives are being taken daily, the company organizes study meetings aimed at the updating of specific themes as needed.

In January 2024, we newly established an in-house certification system for achieving the titles of "Sustainability Associate" and "Sustainability Leader" and have been encouraging employees to obtain the certification as part of our effort to develop sustainability-oriented personnel.

Lingagement and Information Exchange Meetings

Lingagement is a term coined by Daiwa Asset Management by combining "Linkage" with "Engagement" and refers to its activities conducted to provide investee companies with opportunities to discuss issues faced by them with the personnel in charge and executive managers of best practice companies, thereby gaining insights to increase their corporate value going forward.

In November 2024, the company held the fourth information exchange meeting, which is one of its core Lingagement activities. Held on the theme of human capital, the meeting provided participants with an opportunity to share knowledge between companies and to listen to the speeches made by external experts as well as by personnel in charge of human capital at best practice companies and companies embracing challenges in a proactive manner.