Environmental Management

Protecting the global environment, which is the basis of our livelihoods, is essential for a sustainable society. Through our business activities, Daiwa Securities Group contributes to the resolution of environmental issues by developing products that reduce the environmental burden, and also by assisting financing for the development of environmental technologies and infrastructure. At the same time, we are working to establish a system that efficiently collects data on the Group's environmental load. We are also focusing on raising employees' environmental awareness to empower them to reduce the environmental burden in daily business operations.

Through our Sustainability Promotion Structure, we respond to climate change and environmental management.

Environmental Vision

The Group is dedicated to protecting the precious global environment and preserving it for future generations by leveraging financial capabilities.

Environmental Principles

The Group recognizes the importance of environmental principles such as the effort to combat global warming, recycling and reuse of raw materials, and preserving biodiversity, in order to create a sustainable society for the 21st century. The Group pledges to contribute to solving environmental issues through its business as a financial services company and, to constantly seek new ways to reduce its environmental impact as a responsible corporate citizen.

Basic Environmental Policies

- 1.Make positive environmental contributions through our core business activities

We shall seek to develop and provide financial products and services that promote a low-carbon, recycling-oriented, and symbiotic society. - 2.Implement an environmental management system

We shall implement an environmental management system and constantly seek new ways to improve environmental activities. In addition, we shall support environmental education and publicity efforts, while promoting environmental protection efforts by employees. - 3.Take steps to save natural resources, reduce energy consumption, and promote biodiversity system

We shall continue to progress inour efforts to reduce the use of natural resources and energy, and seek ways to improve materials and energy efficiency (including efforts to improve business efficiency). We shall also take steps to reduce water use and reduce, reuse, and recycle other materials to contribute to a more environmentally friendly society. Furthermore, considering the importance of biodiversity, we shall seek a symbiotic relationship with the environment and use safe, clean methods of materials procurement. - 4.Promote environmental communication

Working in concert with business partners, the local community, NGOs and NPOs, we shall actively disseminate information about environmental issues, and communicate our concern for the environment to customers and society at large. - 5.Strictly observe environmental regulations

We shall always aim for environmental preservation, strictly observing environmental laws and regulations in addition to the Group's environmental policies.

Daiwa Securities Group Inc. (May 22, 2012)

Targets for FY2023

- Initiatives for the reduction of GHG emissions

Continue to reduce CO2 emissions by at least 1% compared with the previous fiscal year.- *On a Domestic consolidated basis

- Initiatives for the reduction of electricity consumption

Achieve a reduction of at least 51% in GHG emissions from electricity usage compared with the FY2013 level (as of FY2030)- *On a per unit area basis

- Improve the accumulation of environment-related data and hone analytical skills

- Continue to introduce eco-cars

- Purchase products certified under the Japan's Top Runner Program standards

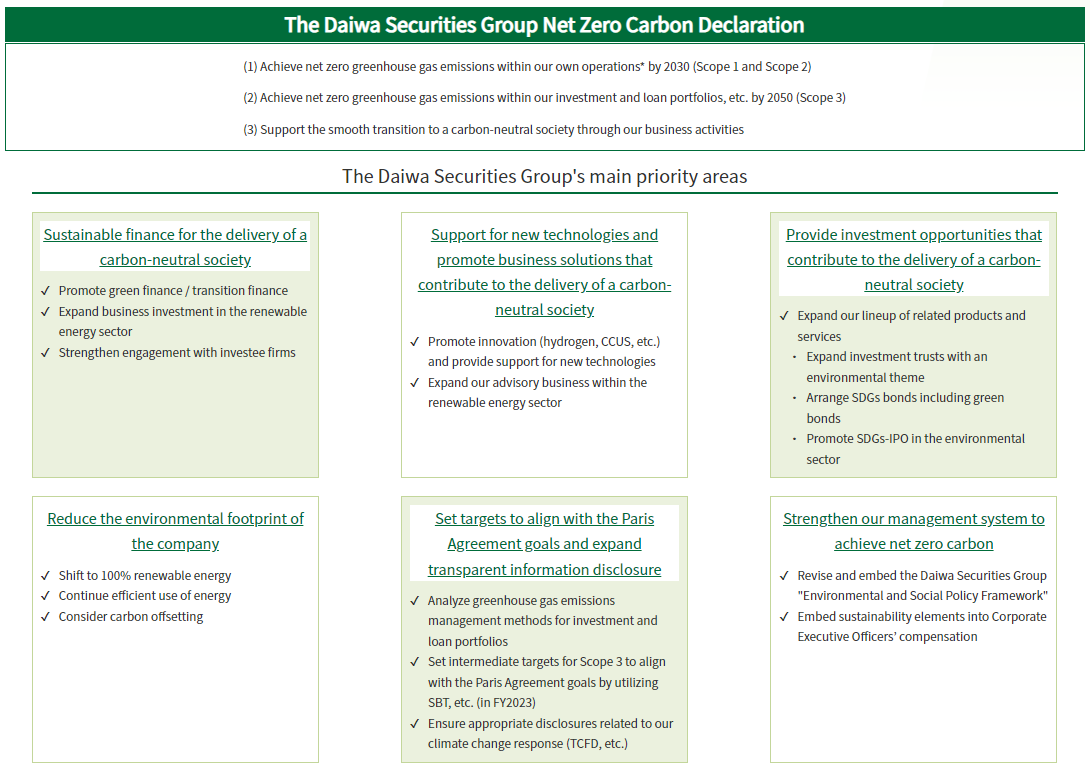

The Daiwa Securities Group Net Zero Carbon Declaration

Towards the early achievement of a carbon-neutral society, the Group has formulated the "Daiwa Securities Group Net Zero Carbon Declaration" that commits to achieving net zero greenhouse gas emissions within our own operations* by FY2030 (Scope 1 and Scope 2), and net zero greenhouse gas emissions across our investment and loan portfolios, etc. by 2050 (Scope 3).

* The company's emissions will be calculated on a consolidated basis

The Daiwa Securities Group Net Zero Carbon Declaration

(1) Achieve net zero greenhouse gas emissions within our own operations* by FY2030 (Scope 1 and Scope 2)

(2) Achieve net zero greenhouse gas emissions within our investment and loan portfolios, etc. by 2050 (Scope 3)

(3) Support the smooth transition to a carbon-neutral society through our business activities

The Daiwa Securities Group's main priority areas

Sustainable finance for the delivery of a carbon-neutral society

✔

Promote green finance / transition finance

✔

Expand business investment in the renewable energy sector

✔

Strengthen engagement with investee firms

Support for new technologies and promote business solutions that contribute to the delivery of a carbon-neutral society

✔

Promote innovation (hydrogen, CCUS, etc.) and provide support for new technologies

✔

Expand our advisory business within the renewable energy sector

Provide investment opportunities that contribute to the delivery of a carbon-neutral society

✔

Expand our lineup of related products and services

・

Expand investment trusts with an environmental theme

・

Arrange SDGs bonds including green bonds

・

Promote SDGs-IPO in the environmental sector

Reduce the environmental footprint of the company

✔

Shift to 100% renewable energy

✔

Continue efficient use of energy

✔

Consider carbon offsetting

Set targets to align with the Paris Agreement goals and expand transparent information disclosure

✔

Analyze greenhouse gas emissions management methods for investment and loan portfolios

✔

Set intermediate targets for Scope 3 to align with the Paris Agreement goals by utilizing SBT, etc. (in FY2023)

✔

Ensure appropriate disclosures related to our climate change response (TCFD, etc.)

Strengthen our management system to achieve net zero carbon

✔

Revise and embed the Daiwa Securities Group "Environmental and Social Policy Framework"

✔

Embed sustainability elements into Corporate Executive Officers' compensation

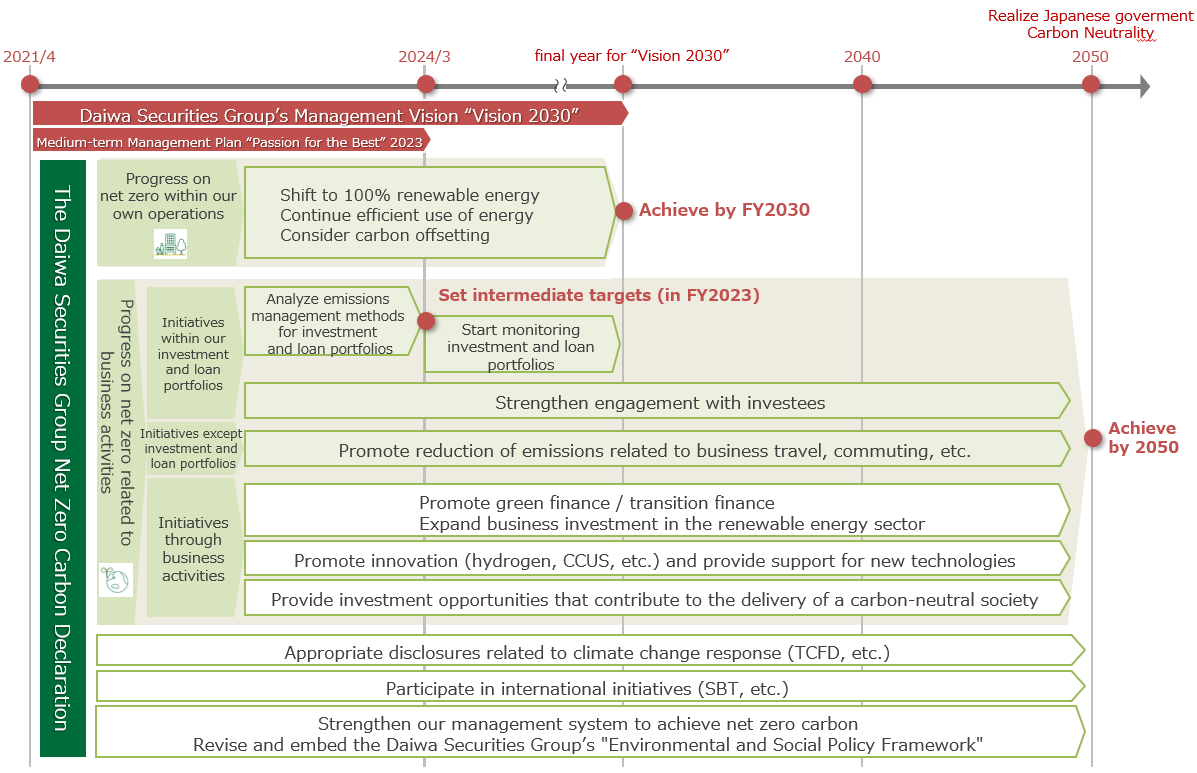

Roadmap for achieving Net Zero Carbon

2021/4

2024/3

final year for "Vision 2030"

2040

Realize Japanese goverment

Carbon Neutrality

2050

Achieve by FY2030

Set intermediate targets (in FY2023)

Achieve

by 2050

Daiwa Securities Group's Management Vision "Vision 2030"

Medium-term Management Plan "Passion for the Best" 2023

The Daiwa Securities Group Net Zero Carbon Declaration

Progress on

net zero within our

own operations

Shift to 100% renewable energy

Continue efficient use of energy

Consider carbon offsetting

Progress on net zero related to

business activities

Initiatives

within our

investment

and loan

portfolios

Initiatives except

investment and

loan portfolios

Initiatives

through

business

activities

Analyze emissions

management methods

for investment

and loan portfolios

Start monitoring

investment and

loan portfolios

Strengthen engagement with investees

Promote reduction of emissions related to business travel, commuting, etc.

Promote green finance / transition finance

Expand business investment in the renewable energy sector

Promote innovation (hydrogen, CCUS, etc.) and provide support for new technologies

Provide investment opportunities that contribute to the delivery of a carbon-neutral society

Appropriate disclosures related to climate change response (TCFD, etc.)

Participate in international initiatives (SBT, etc.)

Strengthen our management system to achieve net zero carbon

Revise and embed the Daiwa Securities Group's "Environmental and Social Policy Framework"