Addressing Natural Capital and Biodiversity: Disclosure based on the TNFD Framework

1. Introduction

In May 2021, Daiwa Securities Group formulated "Vision 2030", our management vision through to 2030. The core concept is "Creating a prosperous future through financial and capital markets." As professionals in the financial and capital markets, we deliver high-quality solutions, while contributing to a carbon neutral society and promoting innovation inside and outside the Group to realize a prosperous future for all.

Vision 2030

"Green & Social" is one of the materialities in our management strategy, and we deliver sustainable finance and other financial products and services that contribute to solving social issues.

We recognize that addressing natural capital is a social issue that needs to be accorded priority while, at the same time, we as a financial institution also recognize this as an opportunity to support companies working toward realizing Nature Positive. Accordingly, we began analysis aimed at disclosing natural capital-related information in FY2023, and have been advancing our disclosure efforts with reference to the TNFD framework, to promote the transition to a nature-positive economy through various businesses.

Our History

| 2018 |

|

|---|---|

| 2020 |

|

| 2021 |

|

| 2022 |

|

| 2023 |

|

| 2024 |

|

| 2025 |

|

2. Governance

(1) Board's Oversight

Governance structure for sustainability issues

The Board of Directors oversees the company's responses to sustainability issues, including those related to natural capital. The Board of Directors is the body that makes resolutions on items that are core management matters and items deemed important by the Board of Directors, established as resolution items in the rules of the Board of Directors, and also receives reports on and discusses natural capital-related issues and responses discussed at the Sustainability Promotion Committee and the Executive Management Committee in accordance with the same rules. The Group's "Vision 2030" includes our basic sustainability policy, and this was decided at the Board of Directors together with the Medium-term Management Plan.

In FY2023, the Board of Directors decided on the Medium-term Management Plan "Passion for the Best" 2026 (including revisions of "Vision 2030") . In this plan, sustainability topics were also raised. The sustainability KPI in the Medium-term Management Plan has been confirmed at a subsequent Board of Directors meeting at the time financial results were approved and the Medium-term Management Plan was reviewed. Other decisions have also been made to date, including the publication and revision of the Environmental and Social Policy Framework (investment and loan policy) that includes consideration for conserving biodiversity.

In response to the growing momentum regarding natural capital, TNFD disclosures were first reported by Daiwa Securities Group Inc. at its FY2024 Board of Directors meeting. The FY2025 Board of Directors meeting also reported on the content of disclosures based on the TNFD framework, including the links between natural capital and enhancement of the Group's corporate value.

Key comments from outside directors

- We should respond while keeping a close eye on the external environment, including opinions and discussions on ESG and trends in international sustainability disclosure standards.

- Japanese companies are proactive in disclosing natural capital-related information; accordingly, nature finance within Japan is expected to expand.

To strengthen executives' incentives regarding responses to sustainability issues, we have incorporated the sustainability KPIs in the evaluation system for performance-linked remuneration. KPIs related to natural capital include the SDGs bond league tables, our own GHG emissions, and investment funding portfolio GHG emissions. The performance assessments used in calculating Performance-linked remuneration reflect the financial performance evaluations, which is based on the Performance KPIs using the financial information and the quality evaluations, which is a comprehensive assessment of the KPIs other than the Performance KPI. The Financial Performance Evaluation and the Quality Evaluation are determined by the Compensation Committee. Performance-linked remuneration is calculated by multiplying the reference amount determined for each position by the performance evaluation, and reflecting the degree of individual contribution.

Numerical Targets in the Medium-Term Management Plan "Passion for the Best" 2026 and FY2024 Results

| FY2026 Targets |

FY2024 Results |

Company wide |

WM | AM | GM&IB | ||

|---|---|---|---|---|---|---|---|

| Performance | Consolidated Ordinary Income | 240 billion yen or higher | 224.7 billion yen | ● | |||

| Consolidated ROE | Around 10% | 9.8% | ● | ||||

| Base Income*1 | 150 billion yen | 137.5 billion yen | ● | ● | |||

| Client Assets | Assets under Custody*2 | 120 trillion yen | 90.2 trillion yen | ● | ● | ||

| Stock-Related Assets*3 | 13.6 trillion yen | 9.8 trillion yen | ● | ||||

| AUM of the Assets Management Division*4 | 44 trillion yen | 34.9 trillion yen | ● | ||||

| Digital | Number of Value Created Digital Projects*5 | 10 projects | 2 projects | ● | |||

| Number of Digital Project Trials*6 | 50 trials | 45 trials | ● | ||||

| Sustainability | SDGs-Related Bond League Table | in the top 2 | 1st | ● | |||

| Engagement Survey Score | 80% or higher | 81% | ● | ||||

| Our Own GHG Emissions*7 | Net zero by FY2030 | 2,725 t-CO2e |

● | ||||

| Investment Funding Portfolio GHG Emissions*7 | 186 to 255 g-CO2e/kWh by FY2030 |

243*8 g-CO2e/kWh |

● | ||||

- *1Base Income: Total ordinary income from WM, Securities AM, and Real Estate AM. Of these, WM is the net total of ordinary income from (former) Retail, Daiwa Next Bank, Daiwa Connect Securities, and Fintertech.

- *2Assets under custody is data of Daiwa Securities.

- *3Stock-related assets refers to investment trusts, fund wraps, and foreign currency deposits.

- *4AUM of the Assets Management Division represents total AUM of Daiwa Asset Management, Daiwa Fund Consulting, Daiwa Real Estate Asset Management, Samty Residential Investment Corporation, Daiwa PI Partners, Daiwa Energy & Infrastructure, and Daiwa Corporate Investment.

- *5The number of value created digital projects is a count of projects that utilize new digital technology that incorporate new innovation or contribute to business transformation.

- *6The number of digital project trials is a count of trial projects for DX proposals and AI/data science projects.

- *7Daiwa Securities greenhouse gas emissions is the total for Scope 1 and Scope 2 emissions (market basis). GHG emissions for our investment financing portfolio indicates project financing in the electricity sector. Includes some estimated figures.

- *8FY2023 result

Performance-linked remuneration system and compensation amounts for FY2024

| Financial Performance Evaluation (100) |

± | Quality Evaluation (-20-+20) |

|||||

|---|---|---|---|---|---|---|---|

| Category | KPI | Points | Reference value | KPI | Reference value | Actual value | |

| Performance | Consolidated ROE | 40 | 10% | 9.8% | |||

| Consolidated Ordinary Income | 40 | 240 billion yen | 224.7 billion yen | ||||

| Base income | 20 | 150 billion yen | 137.5 billion yen | ||||

| Client Assets | Assets under custody | 120 trillion yen | 90.2 trillion yen | ||||

| Stock-related assets | 13.6 trillion yen | 9.8 trillion yen | |||||

| AUM of the Assets Management Division | 44 trillion yen | 34.9 trillion yen | |||||

| Digital | Number of value created digital projects | 10 | 2 | ||||

| Number of digital project trials | 50 | 45 | |||||

| Sustainability | SDG-related bond league table | In top 2 | 1st | ||||

| Engagement Survey score | 80% or higher | 81% | |||||

| Our own GHG emissions | FY2030 Net zero | - | |||||

| Investment funding portfolio GHG emissions | 186-255g-CO2e/kWh | - | |||||

Compensation by Type of Officer, Remuneration, and Number of Eligible Officers

| Type of officer | Total amount of remuneration, etc. (millions of yen) |

Total amount by type of remuneration, etc. (millions of yen) | Number of eligible officers (persons) |

|||||

|---|---|---|---|---|---|---|---|---|

| Base remuneration | RS I | Performance-linked remuneration | Retirement benefits |

|||||

| Cash | RS II | RS III | ||||||

| Director | 66 | 57 | 8 | - | - | - | - | 3 |

| Corporate executive officer (Shikkoyaku) | 1,777 | 517 | 157 | 852 | 182 | 67 | - | 12 |

| Outside director | 139 | 130 | 8 | - | - | - | - | 8 |

- *The remuneration to the five Directors who also serve as the Corporate executive officers(Shikkoyaku) is stated in the column of amount paid to the Corporate executive officers(Shikkoyaku).

- *The amount of Performance-linked remuneration is the amount to be paid for the current fiscal year.

- *For RS III, where performance-linked remuneration exceeds a set upper limit, the portion in excess is paid as restricted stock. The decision was made at the Compensation Committee to change remuneration for Directors and Corporate Executive Officers (Shikkoyaku) from FY2025, and an upper limit was set for performance-linked remuneration (cash) and RS II. The remuneration paid when that threshold is exceeded was changed from RS III to PS, and RS III was abolished.

(2) Execution Framework

Executive Management Committee

Sustainability-related strategies and policies, including those related to natural capital, are discussed and debated by the Executive Management Committee and reported to the Board of Directors as necessary. In FY2025, the Executive Management Committee reported on and discussed the contents of disclosure based on the TNFD framework, including the linkage between natural capital/biodiversity and enhancement of the Group's corporate value, and then reported these to the Board of Directors.

Sustainability Promotion Committee

Regular discussions are held at the Sustainability Promotion Committee chaired by the President & CEO on strategies and policies related to sustainability, including those related to natural capital. The Committee is composed of the Head of Sustainability, who is responsible for promoting sustainability based on the rules for Corporate Executive Officers (Shikkoyaku) approved by the Board of Directors, several Internal Directors, and three external experts with specialized knowledge in sustainability. The details of discussion at the Committee are reported to the Executive Management Committee as appropriate.

Sustainability Expertise of External Experts

| Name | Affiliation/Job title | Expertise |

|---|---|---|

| Toshihide Arimura |

|

|

| Arisa Kishigami |

|

|

| Daisuke Takahashi |

|

|

Key Comments from External Experts

- Since Daiwa Securities Group is already working on business initiatives that will generate opportunities to realize Nature Positive, it may be a good idea to consider setting KPIs that are more specific to natural capital as targets.

- Since diminished natural capital also affects the human rights of local residents, indigenous peoples, etc., we should consider disclosures regarding stakeholder engagement with these parties, NGOs, etc.

- Forward-looking analyses of natural capital-related risks should also take into account future risks and opportunities.

- It is important to pay attention to development of renewable energies that involves environmental destruction, and it is essential to consider ecosystems when expanding renewable energies.

Group Risk Management Committee

Policies and measures relating to risk management, including climate change, are discussed at the Group Risk Management Committee chaired by the President and CEO, a subcommittee of the Executive Management Committee, and attended by the Chief Risk Officer (CRO), who is responsible for risk management. We will consider taking up natural capital as an agenda item in the future.

Group-wide Working groups

As a Group-wide system to promote sustainability, we have appointed Sustainability Managers at each division and major Group company. Under these managers, a working group (WG) monitors sustainability KPIs and promotes sustainability-related businesses. The contents of the discussion of this WG are reported to the Sustainability Promotion Committee as appropriate.

As part of the process for identifying sustainability-related risks and opportunities, including those pertaining to natural capital, the views of each of these WGs are reported to the Sustainability Promotion Committee. In FY2024, Sustainable Business WG members shared issues and discussed countermeasures and improvement plans for the next fiscal year based on the progress made on sustainability KPIs and initiatives with the Head of Sustainability and Sustainability Managers.

Group-wide Working groups

| Name | Description |

|---|---|

| Head of Sustainability | Promote sustainability-related businesses for the entire Group, and oversees initiatives to enhance the foundation for sustainable management. |

| Sustainability Managers | Promote sustainability-related businesses and conduct KPI progress management for each organizations (Headquarters and Group companies) within the Group. |

| Sustainable Business WG | Monitor the KPIs, ascertain the progress status of sustainability-related businesses, identify issues, and plan and implement measures for these issues under the direction of Sustainability Managers. |

| ESG Response WG | Enhance and strengthen ESG response in reference to external evaluations (investors and evaluation organizations) regarding ESG. |

| Sustainability Advisory Group | Composed of internal experts with extensive knowledge in sustainability who make proposals regarding challenges for the Group and future action. |

| Sustainability Disclosure WG | Cross-departmental organizations that aim to expand the disclosure of sustainability information from the perspective of integrated reporting. |

| Scope 3 Emissions Monitoring Team | Monitor emissions relating to the investment and loan portfolios, and sets targets. |

3. Strategy

(1) Daiwa Securities Group's Conception of Natural Capital and Biodiversity

After the adoption of the Kunming-Montreal Global Biodiversity Framework (GBF) in December 2022, the 16th session of the Conference of the Parties (COP16) to the Convention on Biological Diversity was held in October 2024, and international discussions to promote efforts to conserve biodiversity are accelerating.

We recognize that diminished natural capital and biodiversity pose no small risk to our Group, as our business activities and other corporate activities within society and the economy are heavily dependent on and impact natural capital.

On the other hand, the scale of business opportunities resulting from a transition to a nature-positive economy is estimated to be approximately 47 trillion yen per year* by 2030. We believe that we can not only increase our own corporate value but also contribute to Nature Positive by supporting companies working to realize Nature Positive through various businesses.

- *Tentative calculation by the Ministry of the Environment based on estimates by the World Economic Forum (2020)

Relationship between the Group's Businesses and Natural Capital

We have structured our relationship with natural capital as follows based on the Group's roles in the financial and capital markets and its businesses.

(2) Ascertaining dependency and impact on natural capital

Given the importance of natural capital and its relationship to the Group's business, we believe it is the Group's role to contribute to future Nature Positive under appropriate risk management. First, LEAP analysis was initiated in FY2023 to identify businesses, sectors, etc., that are considered to be relatively dependent on and impact natural capital, and to examine future measures to address these aspects.

Analysis with the LEAP Approach in our Group

Identification of relationships with natural capital and screening of priority sectors (analysis by ENCORE)

We used ENCORE to analyze our securities underwriting clients and some of our investees to understand relationships between our Group businesses and natural capital.

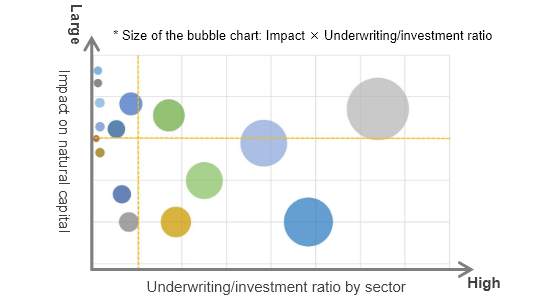

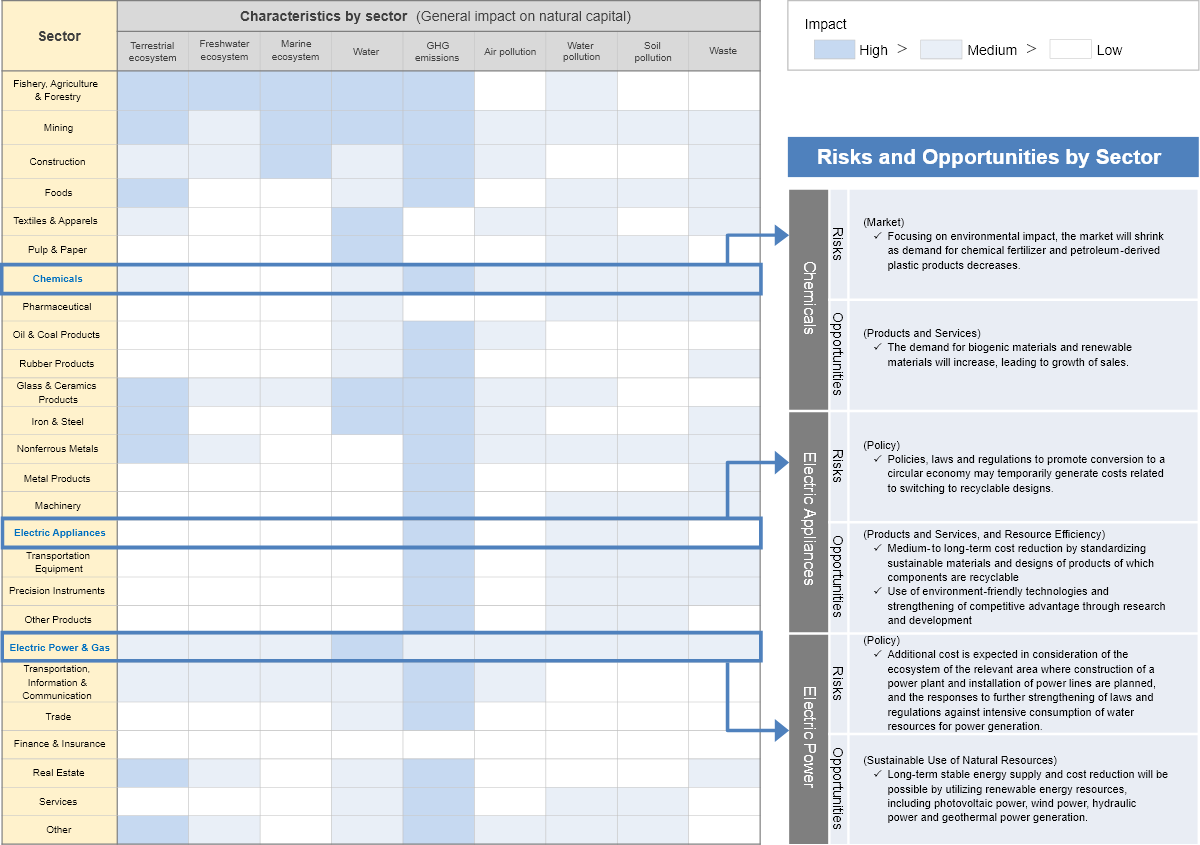

| (1) Understand the degree of impact on natural capital in each sector | (2) Understand the impact of each sector and its relationship with the percentage of underwriting or investment per sector |

|---|---|

|

|

| First, ENCORE was used to identify the degree of impact on natural capital by sector. A heat map was then created after quantifying the impact of each natural capital attribute. |

Based on an understanding of the relationship between the two axes of (1) impact and (2) sector-specific ratios for both underwriting and investment, we screened out priority sectors that have a large impact on natural capital and that meet certain criteria in terms of their underwriting and investment ratios. |

With regard to dependency on natural capital, since all sectors fell below certain criteria in (2), we excluded them from consideration as priority sectors and focused on their impact on natural capital. The results suggest that three sectors—Chemicals, Electric Appliances, and Electric Power and Gas—are priority sectors having particularly large impacts on natural capital.

The initial analysis conducted last fiscal year was done on a trial basis, and will be expanded in stages in the future.

Site evaluation that takes local characteristics into account (analysis using IBAT, etc.)

To identify regions and locations strongly linked to natural capital for our Group's direct operation sites, etc., we have begun to identify and analyze contacts with KBAs*1 and designated protected areas, etc. (priority areas) using IBAT, Aqueduct*2, etc. After more detailed analysis, we will work to conserve, restore, and create natural capital as needed.

- *1Key Biodiversity Area (KBA): An area that is important for the conservation of biodiversity; local information is used to identify areas to be conserved and to avoid or reduce impacts on biodiversity as much as possible.

- *2Aqueduct: The World Resources Institute (WRI) has mapped the risk of water scarcity due to drought around the world, and this tool can be used to assess water stress (the degree of pressure on water demand).

(3) Risks and opportunities

The results of LEAP approach suggest that the Group's primary businesses, Global Markets & Investment Banking Division and Asset Management Division, are susceptible to the risks and opportunities facing securities underwriting clients and investees in priority sectors. Taking into account both these analysis findings and the relevance of natural capital to the Group's businesses, the risks and opportunities for the Group are summarized below.

| Risks or opportunities | Risks or opportunities we can offer to securities underwriting clients, investees, etc. | Potential impacts on our businesses | Impacts on our earnings | |

|---|---|---|---|---|

| Risks | Physical risks |

Deterioration in the earnings of portfolio companies due to shutdowns or revisions to business plans resulting from damage to natural capital caused by natural disasters, etc. |

Deterioration of investment returns in our Group |

Decline in revenue |

| Reconsideration of equity and bond issuances by securities underwriting clients due to damage to natural capital caused by natural disasters, etc. |

Decrease in underwriting commissions and other Group revenue |

|||

| Transition risks |

Delayed efforts to achieve Nature Positive and information disclosure by securities underwriting clients and investees |

Increase in reputational risk to our Group |

||

| Stricter investment standards, laws, and regulations for investors | Increase in response costs associated with improvements and changes in products and services provided by the Group |

|||

| Opportunities | Supporting the growth of companies that are innovating to realize nature-conscious business activities and Nature Positive through the provision of various solutions |

Expanding the Group's revenue base and increasing opportunities to underwrite equities and bonds and invest |

Increase in revenue | |

| Forming funds that help bring about nature positivity and sales of equities and bonds, etc. |

Increasing new investment opportunities for customers |

|||

Based on the insights gained on natural capital-related risks and opportunities, we will continue to deepen our analysis and apply it to engagements with investees and securities underwriting clients. We will also enhance the corporate value of our Group by supporting companies working to realize Nature Positive.

Opportunities for the Group to realize Nature Positive

Opportunity (1): Promote sustainable finance (Global Markets & Investment Banking Division)

The Group is promoting sustainable finance as a way to support fundraising for the huge amount of money required to resolve sustainability issues, and we see this as a business opportunity to provide new added value to our customers.

To date, we have served as the bookrunner for various SDGs bonds, including green bonds and transition bonds, and contributed to market expansion and product diversification.

Key results

| Year | Issuer | Type of Issue | Issue Amount |

|---|---|---|---|

| 2022 | FUJIFILM Holdings | Social bonds (Bookrunner, SA) | Total 120 billion yen |

| NEC | Sustainability-linked bonds (Bookrunner, SA) | Total 110 billion yen | |

| KDDI | Sustainability bonds (Bookrunner, SA) | Total 100 billion yen | |

| 2023 | Republic of Indonesia | Samurai blue bonds (Lead Manager) | 20.7 billion yen |

| Kao | Sustainability-linked bonds (Bookrunner, SA) | 25.0 billion yen | |

| Japan Airlines | Transition bonds (Bookrunner) | 20.0 billion yen | |

| 2024 | Japanese Government | Climate transition interest-bearing bonds (Contracted business*) | - |

| Mitsui O.S.K. Lines | Blue bonds (Bookrunner, SA) | 20.0 billion yen | |

| Central Nippon Expressway | Green bonds (Bookrunner, SA) | 60.0 billion yen | |

| Development Bank of Japan | Transition bonds (Bookrunner, SA) | 10.0 billion yen |

- *Contracted under the FY2023 Promoting Structural Transition Based on Decarbonization Measure Survey Project (survey regarding use of green transition bonds, etc.)

In the area of natural capital, we are focusing on further upgrading sustainability finance, including sustainability-linked bonds that set the number of construction projects contributing to the realization of Nature Positive as a KPI, and the world's first blue bonds for the shipping industry based on international guidance.

Example: Mitsui O.S.K. Lines ("MOL") Blue Bonds (January 2024)

In January 2024, Daiwa Securities served as the Bookrunner and Blue Bond Structuring Agent for the underwriting of MOL's Blue Bonds. The MOL Group is united in its efforts to reduce its impact on the global environment, not only by addressing climate change but also by protecting natural capital and biodiversity, and is developing various social infrastructure businesses centered on marine transport while pursuing ocean sustainability.

Daiwa Securities supported MOL's initiatives toward nature positivity through sustainable finance by supporting the issuance and underwriting of blue bonds to promote these initiatives.

Example: Kajima Sustainability-Linked Bond plus (September 2024)

In September 2024, Daiwa Securities served as the Bookrunner and Structuring Agent for the underwriting of Kajima Sustainability-linked Bond plus. The Kajima Group has set "Carbon neutral, recycling resources, and restoring the natural environment" as one of its materialities (key issues) for both resolving social issues and achieving sustainable Group growth, and is striving to realize carbon neutrality, a circular economy, and nature positivity by 2050 under its "Kajima Environmental Vision 2050plus."

Daiwa Securities supported the Kajima Group's efforts to achieve carbon neutrality, a circular economy, and nature positivity through sustainable finance by supporting the issuance and underwriting of sustainability-linked bonds to promote these efforts.

Opportunity (2): Enhance the medium- to long-term value of investee companies and maintain the sustainability of society (Daiwa Asset Management)

Daiwa Asset Management has established materiality in asset management, one of which is natural capital.

Materiality in asset management

| Critical issues | Specific points of interest |

|---|---|

| Information Disclosure | |

| Climate change |

|

| Natural capital |

|

| Social responsibility |

|

| Human capital |

|

| Improving corporate value |

|

| Other sustainability issues |

|

The materiality identified will be reflected in engagement, voting and investment decisions, and applied to a wide range of business activities, including product development and sales strategies.

Daiwa AM's Vision for Investee Company Best Practice

The company defines its vision of investee company best practice for the sustainable enhancement of corporate value, and conducts reviews of this vision on an ongoing basis. These are used as a tool to achieve more in-depth discussions on enhancing corporate value, including during engagements with investee companies.

- Examples of best practices (natural capital)

-

- 1.Assessment of the current status throughout the value chain

- The company grasps the business continuity risks by identifying links between natural capital (forests, water resources, mineral resources, biodiversity, etc.) and its own business activities, and by analyzing its impact and the extent to which it is dependent on the natural environment.

- 2.Initiatives and disclosure in line with TNFD recommendations

- The company analyzes the relations between business and nature throughout the value chain, and undertakes corporate activities directed toward Nature Positivite.

- The company undertakes initiatives and disclosure in line with the LEAP approach and other TNFD recommendations, including the identification of biodiversity risks and opportunities, scenario planning, and the formulation of business strategies, in an appropriate manner.

- 3.Contributions to the transition to a circular economy

- The company engages in corporate activities which serve to promote the transition to a circular economy by maximizing the value of resources and products, minimizing resource consumption, and mitigating waste generation.

- 1.Assessment of the current status throughout the value chain

Opportunity (3): Establish and sell ESG funds (Daiwa Asset Management)

Daiwa Asset Management provides investment trusts such as ESG funds that invest in companies that are emphasizing ESG or the achievement of the SDGs, so as to help bring about the transition to a sustainable society.

Decarbonization Technology Fund (nicknamed "Carbon ZERO")

The "Decarbonization Technology Fund (nicknamed Carbon ZERO)" (net asset value of 22.4 billion yen*) is Daiwa Asset Management's core ESG fund, with a portion of trust fees donated to tree-planting projects organized by the certified NPO Environmental Relations. Every year around May or June, the NPO collaborates on tree-planting with local forestry cooperatives, and the growth of young trees is managed carefully over a 10-year period after planting. In 2024, 5,425 trees saplings were planted in three locations around Japan, for a cumulative total of 21,529 trees. The number of tree-planting sites in Japan has risen to six.

- *As of the end of October 2025

Clean Tech Equity Fund (nicknamed Mirai Earth)

The "Clean tech Equity Fund (nicknamed Mirai Earth)" (net asset value of 34.1 billion yen*) is one of Daiwa Asset Management's major ESG funds, investing in stocks of clean tech-related companies worldwide. We seek to create environmental and social impacts by investing in companies that are working to solve environment-related issues through, for example, the use of eco-friendly transportation, transitions to alternative energy sources, healthier diets and sustainable food supplies, water resources conservation and reuse, and waste reduction. The social impacts of investments will be measured in terms of carbon dioxide reduction, water usage, etc.

- *As of the end of October 2025

Opportunity (4): Analyze and disseminate information on natural capital and biodiversity (Daiwa Institute of Research)

As an comprehensive securities group, we provide a wide range of information to customers, investors, and other stakeholders, not only on investments but also on the economy and society, as well as policy proposals from a long-term perspective.

Daiwa Institute of Research

As the Group's think-tank, DIR provides a wide range of analysis and information on financial and capital markets and the real economy, and provides policy proposals to the public.

It also actively deliver sustainability-related information, with the ESG Research Section of the Financial Research Department playing a central role in researching, analyzing, and disseminating related information. With progress being made in formulating a framework for sustainability information disclosure and with both issuers and investors becoming increasingly interested, DIR widely disseminates information on disclosure standards such as the TNFD framework and trends in natural capital and biodiversity through reports and other media.

Opportunity (5): Implement eco-friendly initiatives, including natural capital, via real estate investment (Daiwa Real Estate Asset Management)

Daiwa Real Estate Asset Management is undertaking sustainability initiatives to enhance the medium- to long-term value of the investment corporations and funds it is entrusted to manage; among these initiatives is incorporating environmental considerations, including natural capital, into its asset management operations for alternative assets such as real estate.

Eco-friendly initiatives, including natural capital, in properties owned by REITs under management

The REITs managed by the company pay close attention to environmental factors, including natural capital, in the properties they own.

- Introduction and upgrading of water-efficient equipment:

Each investment corporation is improving water conservation through measures such as upgrading to sanitary equipment with excellent water-saving performance and using rainwater and reclaimed water for general service water are being made one after another. - Promoting greening of walls and rooftops:

Daiwa Azabu Terrace, owned by Daiwa Office Investment Corporation, has rooftop gardens with different concepts are set up on the roofs of the 3rd through 6th floors and rooftop floors, and consideration is given to the conservation of biodiversity, such as by implementing a planting plan that takes into account the ecosystem network by adopting many plants that grow indigenous to the area.

In addition, Gran Casa Ryokuchi-koen, owned by Daiwa Securities Living Investment Corporation, has received JHEP* certification (rank A) in recognition of the company's establishment of a self-managed park and planting management that aims to improve the quality of biodiversity.

- *Japan Habitat Evaluation and Certification Program: Japan's only certification system that enables objective and quantitative evaluation, certification, and visualization of contributions to biodiversity conservation; developed and operated by the Ecosystem Conservation Society-Japan.

Opportunity (6): Promote sustainable agriculture that also takes into account natural capital (Daiwa Food & Agriculture)

Established in November 2018, Daiwa Food & Agriculture plays a part in resolving social issues surrounding Japan's agriculture and food sectors by establishing and disseminating business models and creating new investment assets through a "expansion of scale x increase in efficiency x introduction of leading-edge technologies" approach while providing risk money.

Use of materials and technologies that take natural capital into account

Daiwa Food & Agriculture promotes sustainable agriculture utilizing materials and technologies that take natural capital into consideration.

- Use of environmental control systems:

Data on temperature, humidity, carbon dioxide concentration, and other factors in greenhouses are collected and controlled to create an environment suitable for plant growth, leading to energy savings and other benefits. - Utilization of natural enemies:

Chemical pesticide use has been reduced by utilizing natural enemy insects for pest control. - Use of coco peat: Coco peat that can be converted into compost after plant cultivation is being used.

- Recycling of waste liquids: Waste liquids from the culture medium used to grow plants are collected and reused while growing plants.

4. Risk and impact management

(1) Risk management system

Risk management system

To realize the core concept of the Group's management vision "Vision 2030" -- "Creating a prosperous future through financial and capital markets" -- we recognize the importance of identifying, evaluating, and effectively managing various risks associated with our business operations while pursuing profitability and growth. We are working to continuously improve our corporate value by maintaining a sound financial structure and earnings structures that properly balances risk and return and by appropriately managing risks that could materialize not only in the short term, but also in the medium to long term, such as climate- and natural capital-related risks.

(2) Environmental and Social Policy Framework

Our Group has established the "Environmental and Social Policy Framework" to strengthen its management and governance infrastructure for environmental and social risks, including the conservation of the global environmental / biodiversity and the protection of human rights. The Framework covers new investments and loans, and the underwriting of bonds and stocks issuance (hereinafter, financing) made by Daiwa Securities Group Inc. and its major group companies, and specifies businesses in which financing is prohibited and businesses to be restricted.

Prohibited business related to natural capital

- Businesses that negatively impact UNESCO-designated World Heritage Sites

- Businesses that negatively impact wetlands designated under the Ramsar Convention

- Businesses violating the Washington Convention

Restricted business related to nature capital

Businesses affecting indigenous communities

When providing financing to a business, we will carry out ESG due diligence including environmental and social risk assessments ("ESG due diligence"), carefully assessing whether they will cause serious cultural, social and economic damage to indigenous communities, and whether appropriate measures are taken to mitigate them. We will utilize these risk assessments in making decisions.

Palm oil plantation development

When providing financing to a business, we will carry out ESG due diligence, carefully assessing whether the loss of wildlife habitat due to overdevelopment may lead to a loss of biodiversity, or land conflicts with indigenous residents, or human rights violations such as child labor/forced labor/human trafficking, or whether appropriate measures are taken to prevent them. We will utilize these in making decisions.

providing financing to a business, we will confirm if RSPO (Roundtable on Sustainable Palm Oil), an international certification system for palm oil, has been acquired. Where this is not in place, we will encourage our clients to obtain certification. We will encourage our clients to make environmental and human rights policies such as NDPE (No Deforestation, No Peat, and No Exploitation) or other compatible policies.

Regarding new investments and loans, we will encourage our clients to enhance their supply chain management and traceability to ensure that similar initiatives will also apply to their supply chains.

Business involving deforestation

When providing financing to a business, we will carry out ESG due diligence, carefully assessing whether appropriate measures will be taken to prevent a negative impact on the environment caused by the destruction of ecosystems, and whether illegal logging is carried out. We will utilize these results in making decisions.

When providing financing to a business, we will encourage our clients to obtain FSC (Forest Stewardship Council), an international forest system or other compatible certifications or to make environmental and human rights policies such as NDPE or other compatible policies.

Regarding new investments and loans, we will encourage our clients to enhance their supply chain management and traceability to ensure that similar initiatives will also apply to their supply chain.

Large-scale hydroelectric power generation construction

When providing financing to a business, we will carry out ESG due diligence, carefully assessing whether appropriate measures will be taken against the destruction of the environment and ecosystems and negative impacts on local residents due to the construction of a dam. We will utilize these results in making decisions.

Oil and gas development

When providing financing to a business, we will carry out ESG due diligence, carefully assessing whether appropriate measures are taken against their impact on the environment, ecosystems, and local communities. We will utilize these results in making decisions. In particular, we will make careful decisions when providing financing to development businesses in the Arctic, oil sands and shale oil and gas development businesses, pipeline businesses which may have significant negative impacts on the environment and society.

When providing financing to applicable businesses, we will carry out initial ESG due diligence. If it is determined that additional confirmation is necessary as a result of the assessment, we will apply enhanced ESG due diligence to determine whether or not to provide financing. If the implementation of the business may have a serious impact on the corporate value of the Group, the executive management will discuss further and make a final decision on whether or not to provide financing.

In addition, even after new investments and loans have been provided, we will perform regular screenings to ensure that businesses do not involve child labor, forced labor or human trafficking. If we detect credible evidence of child labor, forced labor, or human trafficking, we will engage in dialogue with our clients and request corrective and preventive measures. If no measures are taken, we will carefully consider whether or not to continue our investments and loans.

Based on the experience of its implementation and changes in the external environment, this Framework will be regularly assessed to achieve stricter operations.

Respect for the human rights of natural capital-related stakeholders

The "Human Rights Policy" established by Daiwa Securities Group applies to the human rights of all Group stakeholders. We support and respect international standards on human rights, such as the UN Guiding Principles on Business and Human Rights and the OECD Guidelines for Multinational Enterprises, and conduct appropriate human rights due diligence and stakeholder engagement.

5. Indicators and targets

We established sustainability KPIs in FY2024 as part of the Medium-term Management Plan "Passion for the Best" 2026. Metrics that are also relevant to natural capital include GHG emissions and SDGs bond league table.

Metrics and targets

| Examples of sustainability KPIs relevant to natural capital and biodiversity | FY2026 targets | FY2024 results*1 | ||

|---|---|---|---|---|

| Group KPIs | GHG emissions (our own operations*2) | Consolidated | Net zero (FY2030) |

2,725 t-CO2e |

| GHG emissions (investment portfolio*3) | Consolidated | 186-255 (FY2030) |

243 g-CO2e/kWh | |

| SDGs bond league table | GIB | In the top2 | 1st | |

- *1As of March 31, 2025

- *2Total of Scope 1 and 2 (market-based)

- *3FY2023 result. The targets cover project finance in the power generation sector. Include some estimated values.

For more information, see Climate-related Disclosures 2025 (p.41).

Sector-specific underwriting results are disclosed in the Sustainability Data Edition 2025 (p.24).

We will continuously strive to understand our dependency and impact on natural capital, and we will consider the relationship between our Group and natural capital when setting targets and specific progress indicators.