Risk Management

Daiwa Securities Group recognize the importance of identifying and evaluating the various risks associated with our business operations accurately, and controlling them effectively, while we pursue profitability and growth. We aim to maintain a sound financial base and profit structure by properly balancing risks and returns and appropriately control not only short-term risks but also risks that may appear in the medium- to long-term, such as climate-related risk. By doing so, we seek to achieve sustainable improvement in corporate value.

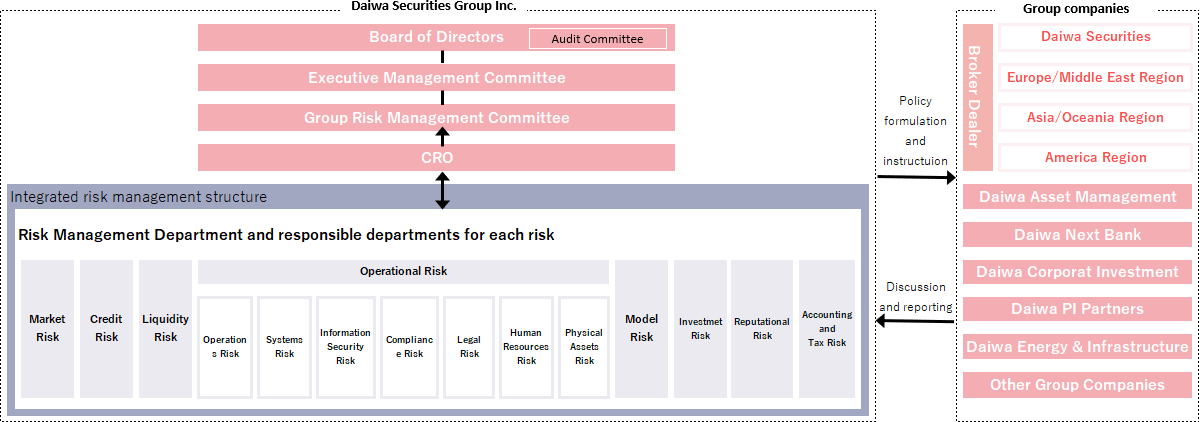

Risk management system

For the Risk Appetite Framework, see Corporate Governance.

Basic policies as defined by the Rules for Risk Management Daiwa Securities Group

- 1.Management's proactive involvement in risk management

- 2.The structure of a risk management system that responds to features of the risks held by the Group

- 3.Understand overall risk based on integrated risk management, and secure strong capital and the soundness of liquidity

- 4.Clarify the risk management process

Each of the Group companies conducts risk management suited to the risk profile and size of each business in accordance with the basic policies related to risk management. The Risk Management Department and responsible departments for each risk within Daiwa Securities Group Inc. monitor the risk management systems and risk status of Group companies. The risk status of Group companies grasped through such monitoring, as well as their risk management issues, is reported as necessary to the CRO, who is appointed from among the executive officers. The CRO gives directions to address the risk management system, risk status, and other risk issues for each company, verifies the effectiveness of risk management systems, and conducts reviews as necessary according to the business scale and characteristics and risk status of each company.

The CRO is in charge of reporting risk to the CEO and does not concurrently serve as the person responsible for internal audits or as a member of the Audit Committee.

The risk status and other risk issues of Group companies are reported to the Group Risk Management Committee, which is a sub-committee of the Executive Management Committee of Daiwa Securities Group Inc. The committee deliberates and decides on policies on risk management and specific measures. Risk management processes are also discussed and reviewed by the Group Risk Management Committee. The Group Risk Management Committee is structured separate from the Audit Committee, but the content of its meetings is also reported to the Audit Committee. The Board of Directors also verifies the effectiveness of risk management systems and processes through deliberation and decisions on matters related to the RAF, top risks, and so on. The risk management process is also discussed by the Group Risk Management Committee, and is reviewed based on suggestions and directions from executive officers. In addition, major Group companies regularly hold risk management meetings in order to strengthen their risk management systems.

Integrated Risk Management

Integrated risk management refers to a risk management method that grasps the overall risks that the Group is facing and compares them with management strength for sustainable improvement of corporate value and securing of management safety. In performing integrated risk management, the Group strives to comprehensively understand risks by using stress tests* and top risk management based on RAF and measuring the impact on capital and liquidity within the Group from a forward-looking perspective.

- *Stress tests are used for the integrated evaluation of impacts on capital, liquidity, and business systems based on probable stress scenarios that may have a major impact on the Group.

Environmental and Social Policy Framework

Daiwa Securities Group Inc. formulated the "Environmental and Social Policy Framework" in June 2021 to strengthen its management and governance system for environmental and social risks related to business activities. The framework will be reviewed on a regular basis, at least once a year, based on implementation experience and changes in the external environment, with deliberations by the Board of Directors to ensure more rigorous operations. By recognizing and appropriately addressing risks associated with business that could have a significant negative impact on environment and/or society through initiatives such as the engagements with our stakeholders including investees and/or borrowers, Daiwa Securities Group strengthens our supply chain management and strives to create a better society along with its stakeholders.

- *Daiwa Asset Management Co. Ltd. has established a policy as an "ESG Investment Policy," and Daiwa Real Estate Asset Management Co. Ltd. has established a policy as a "Policy Regarding ESG" separately from this framework.

Daiwa Securities Group "Environmental and Social Policy Framework"

- 1.Introduction

As awareness of environmental and social issues such as climate change and human rights violations continues to grow in Japan and overseas, the Daiwa Securities Group (the "Group") is committed to playing its role, as a comprehensive securities group, in supporting the realization of a sustainable and prosperous society in order to meet the environmental and social goals of all stakeholders.

The Group established its "Environmental Vision" in 2012 and, based on the "Environmental Principles" and the "Basic Environmental Policies" announced at the same time, it has been working to solve environmental issues and continuously reduce the environmental burden throughout its business activities. Furthermore, in May 2021, the Group established its management vision "Vision 2030". It clarifies its intention to work proactively towards the promotion of the transition to a carbon-neutral society and the realization of a resilient society.

In addition, the Group has formulated the "Environmental and Social Policy Framework" (the "Framework") in order to strengthen its management and governance system for environmental and social risks, such as the conservation of the global environment / biodiversity, and respect for human rights. We will create a better society in partnership with our stakeholders by acknowledging the risks for businesses that may have negative impacts on the environment and society, and taking appropriate measures through engagement.

The Group will actively support innovation and technological initiatives that will lead to the realization of carbon neutrality, and will focus on providing a variety of financial solutions, including transition finance, to support these. - 2.Governance on this Framework

The Group discusses SDGs and ESG issues related to the environment and society at the Sustainability Promotion Committee, chaired by the President and CEO. The results of these discussions are reported to the Board of Directors as appropriate, and important matters are passed through the Board of Directors as resolutions, which strengthens the system of supervision by the Board of Directors. This Framework was approved by the Board of Directors following discussions with the Sustainability Promotion Committee.

This Framework will be assessed regularly, with the aim of strengthening it, based on the experience of its implementation and changes in the external environment. - 3.Applicable products and services

This Framework covers new investments and loans, and the underwriting of bonds and stocks issuance (hereinafter, financing) made by Daiwa Securities Group Inc. and its major group companies. - 4.Applicable business

(1) Prohibition

- Projects that negatively impact UNESCO-designated World Heritage Sites

- Projects that negatively impact wetlands designated under the Ramsar Convention

- Projects violating the Washington Convention

- Projects involving child labor, forced labor or human trafficking

(2) Restriction

1) Indigenous communities

When providing financing for a project, we will carry out ESG due diligence including environmental and social risk assessments ("ESG due diligence"), carefully assessing whether they will cause serious cultural, social, or economic damage to indigenous communities and whether appropriate measures are taken to mitigate them. We will utilize these risk assessments in making decisions.2) Land expropriation that leads to involuntary relocation of residents

When providing financing for a project, we will carry out ESG due diligence, carefully assessing whether they result in land expropriation that forces residents to relocate against their wishes and whether appropriate measures are taken to prevent them. We will utilize these results in making decisions.3) Coal-fired power generation

We prohibit any financing where the use of proceeds is directed toward the new construction of coal-fired power generation or the expansion of existing facilities.

Regarding the underwriting of bonds and stocks issuance, however, issuers that announce a target for net zero greenhouse gas (GHG) emissions by 2050, or projects adopting new technology aligned with the goals of the Paris Agreement, may be considered on a case-by-case basis.4) Weapons of mass destruction / inhumane weapons manufacturing

We prohibit any financing where the use of proceeds is directed toward this type of project. Weapons of mass destruction include nuclear weapons, chemical weapons, and biological weapons. Inhumane weapons include cluster munitions and antipersonnel land mines.5) Palm oil plantation development

When providing financing for a project, we will carry out ESG due diligence, carefully assessing whether uncontrolled development may lead to the loss of wildlife habitat and biodiversity, whether there are any land conflicts with indigenous peoples, or human rights violations such as child labor/forced labor/human trafficking, and whether appropriate measures are taken to prevent them. We will utilize these results in making decisions.

In addition, we will confirm if RSPO (Roundtable on Sustainable Palm Oil), an international certification system for palm oil, has been acquired. If it is not obtained, we will encourage our clients to obtain certification. Also, we will encourage our clients to make environmental and human rights policies such as NDPE (No Deforestation, No Peat and No Exploitation) or other compatible policies.

Regarding new investments and loans, we will encourage our clients to enhance their supply chain management and traceability to ensure that similar initiatives will also apply to their supply chain.6) Deforestation

When providing financing for a project, we will carry out ESG due diligence, carefully assessing whether appropriate measures will be taken to prevent a negative impact on the environment caused by the destruction of ecosystems, and whether illegal logging is carried out. We will utilize these results in making decisions.

In addition, we will encourage our clients to obtain FSC (Forest Stewardship Council), an international forest certification system or other compatible certifications, and to make environmental and human rights policies such as NDPE or other compatible policies.

Regarding new investments and loans, we will encourage our clients to enhance their supply chain management and traceability to ensure that similar initiatives will also apply to their supply chain.7) Coal mining

We prohibit any financing where the use of proceeds is directed toward projects using the mountaintop removal (MTR) method, the new development of thermal coal mining, the expansion of existing thermal coal mining, or the new development and expansion of infrastructure dedicated to thermal coal mining.

Regarding the underwriting of bonds and stocks issuance, however, issuers that announce a target for net zero GHG emissions by 2050 may be considered on a case-by-case basis.

When providing financing for a project, we will carry out ESG due diligence, carefully assessing whether appropriate measures are taken to ensure occupational safety and a sanitary environment to prevent cave-in accidents, flood accidents, gas explosions, and human rights violations such as illegal labor. We will utilize these results in making decisions.8) Large-scale hydroelectric power generation construction

When providing financing for a project, we will carry out ESG due diligence, carefully assessing whether appropriate measures will be taken to address destruction of the environment and ecosystems and negative impacts on local residents due to the construction of a dam. We will utilize these results in making decisions.9) Oil and gas development

When providing financing for a project, we will carry out ESG due diligence, carefully assessing whether appropriate measures have been taken to address impacts on the environment, ecosystems, and local communities. We will utilize these results in making decisions. In particular, we will make careful decisions when providing financing to development projects in the Arctic, oil sands and shale oil and gas development projects, pipeline projects which may have significant negative impacts on the environment and society.10) Woody biomass power generation

When providing financing for a project where the use of proceeds is directed toward the new construction of woody biomass power generation or the expansion of existing facilities, we will carry out ESG due diligence, carefully assessing the sustainability of fuel sources, GHG emissions throughout the entire lifecycle, and the human rights of local residents. We will utilize these results in making decisions.

Woody biomass power generation includes both single-fired and co-fired plants. - 5.Assessment process

When providing financing for applicable projects, we will carry out initial ESG due diligence. If it is determined that further verification is required as a result of the assessment, we will apply enhanced ESG due diligence to determine whether to provide financing. If the implementation of the project may have a serious impact on the corporate value of the Group, the executive management will discuss further and make a final decision on whether to provide financing.

In addition, even after new investments and loans have been provided, we will perform regular screenings to ensure that projects do not involve child labor, forced labor, or human trafficking. If we detect credible evidence of child labor, forced labor, or human trafficking, we will request corrective and preventive measures through dialogue. If no measures are taken, we will carefully consider whether to continue our investments and loans. - December 26, 2025

- Please also refer to the following.

- Stakeholder Engagement

- Supply Chain Management

- Respect for Human Rights

Top Risks

The risk events that require particular attention in light of the Group's business characteristics are selected and managed as top risks. The management of Company "visualize" the risk events that are identified and sorted out by relevant departments based on risk events collected from both inside and outside the Company as candidates for top risks to enabling the management to understand and discuss extensive risks when selecting the top risks. Moreover, the Group's Directors and Corporate Executive Officers identify and extract such candidates for top risks by making a forward-looking evaluation of the level of impact on the Group's performance and the possibility that such risk events will occur.

List of top risks

| Risk events | Specific examples |

|---|---|

| Intensifying international disputes and conflicts |

|

| Trump 2.0 |

|

| China's economic crisis |

|

| Downgrading of JGBs and crash of yen assets caused by the instability of Japan's financial situation |

|

| Japan's stagflation risk |

|

| Recurrence of the financial crises |

|

| Stagnation in sustainable growth due labor and personnel shortages |

|

| Large-scale earthquakes |

|

| Epidemic of a new infectious disease |

|

| Cyberattack |

|

| Inappropriate actions by officers and employees |

|

| Insufficient response to money laundering and terrorist financing |

|

| Information security risk |

|

Types of Risks to Be Managed

Daiwa Securities Group faces various risks in the course of its business activities. The Group therefore believes that it is important to identify these based on business characteristics and risk profiles, and appropriately evaluate and manage those risks in order to maintain a sound financial base and earnings structure.

The Group classifies risks that occur in business into market risk, credit risk, liquidity risk, operational risk, model risk, and so on, and puts in place risk management systems that respond to respective risk types.

Management Systems of Major Risks

(1) Market risk management

Market risk refers to the risk of incurring losses due to market fluctuations, which affect the value of stock prices, interest rates, foreign exchange rates, and commodity prices. In terms of the Group's trading business, by providing market liquidity the Group acquires compensation while at the same time taking on market risk through the holding of a certain amount of financial assets. The Group implements suitable hedges to curtail fluctuations in profits and losses. However, as hedges may fail to function effectively in times of stress, the Group sets limits on Value at Risk (VaR)*1 and loss estimates under various types of stress test*2 to ensure that they are within the scope of equity capital, after taking into consideration financial conditions and such factors as the business plans and budgets of subject departments. The Group also sets limits on such facets as position and sensitivity.

The departments in charge of the Group's trading services calculate positions and sensitivity for the purpose of assessing their own market risk, and monitor such. Meanwhile, risk management departments also monitor the status of market risk, confirm whether risk falls within the established limits, and report on such to management on a daily basis.

- *1Value at Risk (VaR) represents the maximum possible loss of a given trading portfolio with a given probability over a given time horizon.

- *2Stress tests are used to calculate the Group's maximum losses based on scenarios of the most significant market fluctuations of the past and due to scenarios based on hypothetical risk events.

(2) Credit risk management

Credit risk refers to the risk of losses caused in cases where a counterparty of a trade or the issuer of a financial product held by the Group suffers a default, or credibility deteriorates. The credit risks generated in the trading business of the Group consist of counterparty risk and issuer risk.

With regard to counterparty risk, the Group has established an upper limit on the credit-equivalent exposure that can be tolerated for each counterparty and periodically monitors such credit-equivalent exposure. The Group also monitors risk amount related to the issuer risk of financial instruments held for market making.

Because the Group provides financial instruments, manages assets and invests, the Group is exposed to the risk that various instrument and transaction exposures collect on a specific counterparty. If the counterparty's credit situation worsens, the Group may incur significant losses. Therefore, the Group has established the upper limit on total exposure to any counterparty and periodically monitors such limit.

(3) Liquidity risk management

Liquidity risk refers to the risk of experiencing cash management difficulties or suffering losses due to having to finance at markedly higher costs than usual as a result of a change in market conditions or a deterioration of Group companies' finance.

Daiwa Securities Group Inc. has organized its liquidity management system that utilizes the regulatory consolidated liquidity coverage ratio and the consolidated net stable funding ratio as well as its own liquidity management indicators.

Concerning unsecured fundraising, the repayment date of which arrives within a year and the prospective outflows in the case where some stress events occur in such period, we verify every day that enough liquidity is secured for such repayment and outflows even in various stress scenarios. The Group undertakes to make it possible to continue business even if unsecured fundraising is not available for one year.

The Group recognizes the emergence of liquidity risks can have a direct impact that leads to the business failure of a financial institution. Accordingly, Daiwa Securities Group has put in place a contingency funding plan that predefines the required response methods, roles and authorities, and procedures, among others, in order to ensure that the Group responds appropriately as a unified entity at the time of a liquidity crisis. This plan states the basic policy concerning the reporting lines depending upon the urgency of stress internally originated, including a credit crunch, and externally originated including an abrupt change in the market environment, and the method of raising capital. The contingency plan enables the Group to prepare a system for securing liquidity through a swift response.

(4) Operational risk management

Operational risk is the risk of losses that occur when internal processes, people, and systems do not perform adequately or do not function; it can also arise from external events.

The Group classifies operational risks into the seven categories of operations risk, systems risk, information security risk, compliance risk (including conduct risk), legal risk, human resources risk and tangible assets risk and monitors them by assigning departments responsible for individual risks. As the Group's business becomes more sophisticated, diversified, and systemized, the accompanying risks become more varied. As a result, the importance of managing operational risk has grown each year.

Major Group companies strive to appropriately manage operational risk by measures including risk control self-assessments (RCSAs), in accordance with rules on operational risk management set by Daiwa Securities Group Inc. Additionally, the Group has enacted the necessary policies including the tightening of authority, the machine automation of office functions to reduce human errors, and creating operational manuals, working to reduce operational risk in response to the business characteristics of each Group company.

- *RCSA (Risk Control Self-Assessment) uses a predetermined assessment sheet to identify and assess operational risks, analyzes risks based on frequency of occurrence and impact, and evaluates and verifies efficacy of risk mitigation efforts.

(5) Model risk management

Model risk refers to the risk of direct and indirect losses resulting from errors in the development and implementation of models, or from their misuse.

In order to effectively manage model risk, the Group has clarified the roles and responsibilities of those involved in the models, and has established a system to manage models throughout their lifecycle. Specifically, the Group has model verification and approval processes before use or significant change, and conducts monitoring and regular checks to manage model risk.

(6) Investment risk management

Investment risk refers to the risk that the value of an investment made by the Group will be damaged, or that additional funding will be required, and to the risk that the return on investment will be lower than expected due to deterioration of the business performance and credit status of the investee, and to changes in the market environment. This risk is managed at the portfolio level and at the individual investment level.

In terms of portfolio level management, the Group has set Group-wide risk limits on a per industry basis in order to appropriately manage the investment concentration condition, and regularly monitors this situation. In terms of individual investment level management, along with verifying risk prior to making the investment based on a certain standard, the Group monitors the risk condition following investment on an ongoing basis.

(7) Reputational risk management

Reputational risk refers to the possibility of the Group sustaining unforeseen losses and the Group's counterparties being adversely affected due to a deterioration of its reliability, reputation, and assessment caused by the spread of rumors or erroneous information. There are no uniform procedures for managing reputational risk because it can emanate from a variety of sources.

The Group has established various regulations under its Disclosure Policy, with particular emphasis on the management and provision of information. It has also set up the Disclosure Committee within Daiwa Securities Group Inc.

Each Group company is obligated to report information that could turn into reputational risk to the Disclosure Committee.

That way, Daiwa Securities Group Inc. can obtain and centrally manage information, and it disseminates accurate information in a prompt manner according to the decisions of the Disclosure Committee.

The Group strives to keep abreast of problems and occurrences that may affect its reputation so that if and when such problems occur, their impact on the Group can be minimized. It also acts to ensure that erroneous and inaccurate information is properly corrected, and that it responds appropriately to libel and other issues. The Group has public relations and investor relations systems in place to prevent and minimize risks regarding its reputation.

(8) Accounting and tax risk management

Accounting and tax risk is the risk of not conducting appropriate accounting treatment and disclosure in accordance with accounting or taxation standards, laws, and regulations, or of not filing or paying taxes appropriately, as well as the risk of losses arising as a result.

The Group strives to reduce accounting risk by operating in accordance with fundamental regulations related to internal controls on financial reporting, and by establishing, putting into practice, and striving to improve its internal controls on financial reporting.

In addition, by notifying principal Group companies of necessary reporting items related to tax risk management and receiving such items in a timely manner, the Group endeavors to appropriately determine the tax risk management status and risk conditions for the Group as a whole, thereby reducing its tax risk.

Business Continuity Plan (BCP)

To be prepared for disruptions of social infrastructures, we have drawn up a business continuity plan (BCP). The BCP prioritizes important operations to be restored or continued* in order to keep the financial markets open and protect customers' economic activities. Disruptions of social infrastructure might make our head office functions, branches and data centers or other important facilities inoperative. They can be caused by events such as earthquakes, fires, storms, floods, other extraordinary weather conditions, terrorism, large-scale power failures, and serious outbreaks of infectious diseases. In accordance with the BCP, we will not only ensure the safety of customers and our employees, and protect our assets, but will also strive to continue our vital operations in the financial markets where our business serves the public interest. For example, we boast Japan's highest level backup center, and have established a system which enables us to easily switch to the alternate system in case of an emergency at headquarters. We can therefore continue vital operations through a substitute office location.

Prioritized operations to be restored or continued

- 1.Carrying out securities transactions traded in the markets and yet to be settled

- 2.Payment to our customers

- 3.New orders from customers to sell or cancel the following products and sell securities back to exit a long position in margin trading

-

- Domestic listed shares, including closing long positions on margin transactions

- MRF (money reserve funds)

- Japanese government bonds for individual investors

- Ordinary deposits

Measures to Address Disaster Risk by Region

Daiwa Securities has offices across Japan. As disaster risk differs amongst regions, it has formulated a disaster response plan for each sales branch and is preparing disaster relief supplies that reflect the disaster risk for each branch. The hazard maps created by the municipalities of respective regions are sent to branches and made available on our intranet.