Corporate Governance

Basic Views on Corporate Governance

Daiwa Securities Group Inc. will respect the rights and interests of the shareholders, consider the position of all stakeholders and strive for sustainable growth and improvement of medium to long term corporate value through realization of our corporate principles "Building trust," "Placing importance on personnel," "Contributing to society," and "Maintaining healthy earnings results."

For that purpose, the Company practices group management based on a holding company structure, establishes a highly transparent and objective governance environment that conforms to international standards, realizes highly efficient oversight of group companies and builds a unified group management system that elicits synergies among group companies.

The Company has adopted Three Committees system (a company with nominating committee, etc.) as an institutional design in order to supervise management through the following (1) and (2).

- (1)Making swift and decisive decisions by having the Board of Directors assign wide-ranging authority to Corporate Executive Officers (Shikkoyaku) and clarifying the division of the duties among Corporate Executive Officers (Shikkoyaku)

- (2)Improving transparency and fairness of the management by establishing three committees: the Nominating Committee, Audit Committee, and Compensation Committee with highly independent Outside Directors as a majority of the members

Furthermore, the Company positively addresses corporate social responsibility activities in order to obtain trust from all of the stakeholders. There are indeed various aspects to corporate social responsibility, such as providing superior products, services, and sincere responses to customers; returning profits appropriately and disclosing information to shareholders appropriately; taking measures for labor environment and evaluation of the employees; establishing legal compliance and corporate ethics; environmental management; as well as social contribution.

The Company believes that these approaches, together with a strengthened corporate governance system which emphasizes transparency, mobility and efficiency will lead to the sustainable improvement of the corporate value.

Reference: Corporate culture supporting Daiwa Securities Group

Corporate Governance Guidelines

The Company's Corporate Governance Guidelines define the basic framework and policies of the Daiwa Securities Group's corporate governance.

Key Points of the Corporate Governance Guidelines

- Composition of the Board of Directors

- One-third or more of the members of the Board of Directors shall be independent Outside Directors with a high degree of expertise and a sense of ethics.

- As a general rule, the majority of the Directors shall not concurrently serve as Corporate Executive Officers (Shikkoyaku).

- In principle, the Company shall keep the ratio of female Directors at 30% or more.

- Composition of the Committee

- The Committees (which refers to the Nominating, Compensation, and Audit Committees) are composed of three or more members selected by the Board of Directors from among the Directors, and the majority of the members are Outside Directors.

- The Chairpersons of the Committees are determined by the Committees from among the Outside Directors who are members of the Committees.

- The role of the Board of Directors

- To decide on core management matters, such as basic management policies, the election and dismissal of Corporate Executive Officers (Shikkoyaku), the development of internal control systems and risk management environments, and matters related to the division of duties and command system among Corporate Executive Officers (Shikkoyaku).

- To ensure the flexibility of decision-making, in principle, delegated decision-making authority regarding business execution to the Corporate Executive Officers (Shikkoyaku) except for the matters that are to be decided by the Board of Directors under laws and regulations.

- To oversee the execution of duties by Directors and Corporate Executive Officers (Shikkoyaku).

- The role of Outside Directors

- As directors, Outside Directors oversee the execution of duties by Corporate Executive Officers (Shikkoyaku) from an independent and neutral standpoint, while providing appropriate opinions, or making appropriate determination as members of each committee.

- Outside Directors are expected to provide advice on management, based on their knowledge and experience.

- The tenure of the Outside Directors

- In principle, the total tenure of Outside Directors shall not exceed 8 years, with a maximum of 10 years.

- The Outside Directors' Committee

- The Committee shall be composed of Outside Directors, with the chairperson determined from among the members.

- Support Systems for Directors

- To support director training and the acquisition of information and knowledge

- Sharing internal information with Outside Directors

- Bearing necessary costs for Outside Directors to fulfill their roles

- Establishment of the Board Members' Office

- Succession Plans for the position of CEO

- The CEO establishes a succession plan for the CEO based on management strategy, business strategy, and other matters, and reports it to the Nominating Committee.

- The Nominating Committee appropriately oversees the details of the plan.

- The Board of Directors resolves the election and dismissal of the CEO based on deliberations of the nominating Committee.

- The Board of Directors dismisses the CEO if they determine that the CEO cannot fully fulfill the roles of the CEO and conclude that it is appropriate to dismiss the CEO.

- Succession plans are also formulated in preparation for the unexpected that may happen to the CEO.

- Evaluating the effectiveness of the Board of Directors

- The Board of Directors conducts a survey once every year with each of the Directors.

- The Board of Directors examines and discusses the results of the survey and evaluates the effectiveness of the Board of Directors. They urge improvement for issues recognized as a result of such discussions and endeavor to maintain and improve the effectiveness.

| Daiwa Securities Group Inc. Corporate Governance Guidelines | |

|---|---|

|

|

Corporate Governance System

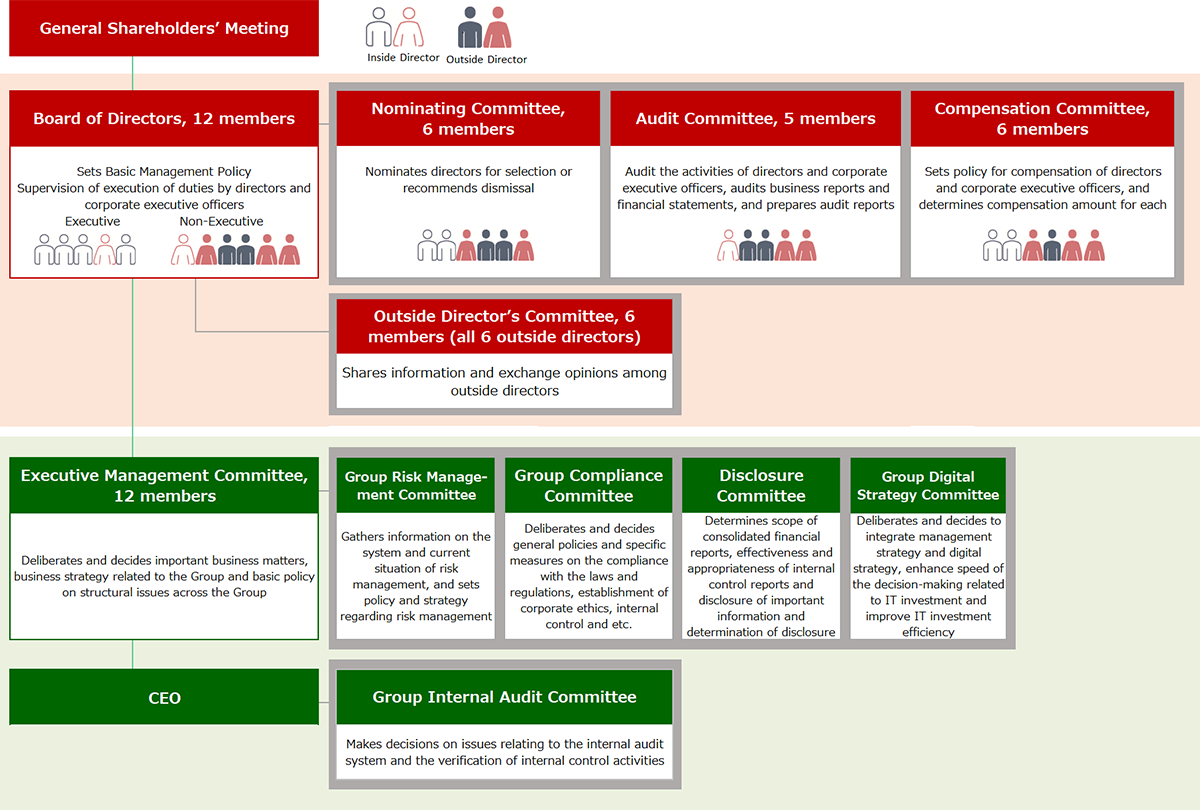

The corporate governance system of the Company consists of the Board of Directors and the following Three Committees (Nominating Committee, Audit Committee, and Compensation Committee) as a supervising body, Outside Directors' Committee as a subcommittee of the Board of Directors, Executive Management Committee and its subcommittees (Group Risk Management Committee, Group Compliance Committee, Disclosure Committee, Group Digital Strategy Committee, and Group Internal Audit Committee), which is in direct control of the CEO as an internal audit body.

Corporate Governance System at Daiwa Securities Group

Board of Directors and Committees: Roles, Duties, Composition and Activities

For roles, duties, composition and activities of the Board of Directors and the Committees, refer to:

- Corporate Governance Report

- Securities Reports

- Daiwa Securities Group Integrated Reports

- Sustainability Data Edition

| List of Items | Corporate Governance Report | Securities Report | |

|---|---|---|---|

| Board of Directors | Role and responsibility | ● | ● (including agenda) |

| Members and their status of attendance | ● | ● | |

| Evaluating the effectiveness of the Board of Directors | ● | ||

| Nominating Committee | Role and responsibility | ● | ● (including agenda) |

| Composition | ● | ● | |

| Members and their status of attendance | ● | ● | |

| Nomination policies, etc. | ● | ● | |

| Audit Committee | Role and responsibility | ● | ● (including agenda) |

| Composition | ● | ● | |

| Members and their status of attendance | ● | ● | |

| Audit Committee's activities | ● | ● | |

| Compensation Committee | Role and responsibility | ● | ● (including agenda) |

| Composition | ● | ● | |

| Members and their status of attendance | ● | ● | |

| Outside Directors' Committee | Role and responsibility | ● (including agenda) | ● (including agenda) |

| Executive Management Committee | Role and responsibility | ● | ● |

| Composition | ● | ● | |

| Subcommittees | ● | ● | |

| Group Internal Audit Committee | Role and responsibility | ● | ● |

| Composition | ● | ● | |

| Role and Responsibilities in the Company | Years on Board | Corporate management | Finance / Accounting | Legal / Compliance | DX / ICT | Global business | Sustainability *1 | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Seiji Nakata | Chairperson of the Board and Corporate Executive Officer | Nominating Committee | Compensation Committee | 10 years | They have expertise and experience to execute adequately the management and control of the Group. |

● | |||||

| Akihiko Ogino | Member of the Board, Representative Corporate Executive Officer, President and CEO |

Nominating Committee | Compensation Committee | 5 years | ● | ||||||

| Shinsuke Niizuma | Member of the Board, Representative Corporate Executive Officer, Deputy President, COO and Head of Wealth Management |

1 year | |||||||||

| Keiko Tashiro | Member of the Board, Deputy President, Corporate Executive Officer, Head of Asset Management, Securities Asset Management, Sustainability and Financial Education |

11 years | ● | ● | |||||||

| Eiji Sato | Member of the Board, Senior Executive Managing Director, Corporate Executive Officer, Head of Corporate Planning and Deputy Head of Overseas Operations |

1 year | |||||||||

| Hiroko Sakurai | Senior Executive Managing Director, Corporate Executive Officer, Head of Compliance |

- | |||||||||

| Sachiko Hanaoka | Member of the Board | Audit Committee | 6 years | ||||||||

| Role and Responsibilities in the Company (★ indicates a Chairperson of the committee) |

Years on Board | Corporate management | Finance / Accounting | Legal / Compliance | DX / ICT | Global business | Sustainability *1 | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Eriko Kawai | Outside Director | Nominating Committee | Compensation Committee★ | 7 years | ● | ● | ● | ||||

| Katsuyuki Nishikawa | Outside Director | Nominating Committee | Audit Committee★ | 6 years | ● | ● | |||||

| Toshio Iwamoto | Outside Director | Nominating Committee★ | Compensation Committee | 5 years | ● | ● | ● | ● | |||

| Yumiko Murakami | Outside Director | Audit Committee | Compensation Committee | 4 years | ● | ● | ● | ||||

| Noriko Iki | Outside Director | Nominating Committee | Audit Committee | 2 years | ● | ● | ● | ||||

| Mami Yunoki *2 | Outside Director | Audit Committee | Compensation Committee | 1 year | ● | ● | |||||

| Akira Ichikawa | Outside Director | Nominating Committee | Compensation Committee | - | ● | ● | ● | ||||

- *1Criteria: People with experience in sustainability-related work (including experience in promoting the Group's sustainability strategy)

- *2Ms. Mami Yuzuki's name in her family register is Mami Kato.

Evaluating the Effectiveness of the Board of Directors

Since FY 2014, Daiwa Securities Group Inc. has conducted annual evaluations of the effectiveness of the Board of Directors with the aim of identifying issues and implementing improvements to enhance its effectiveness. For details, please refer to the Corporate Governance Report. The summary of findings and responses from past effectiveness evaluations is shown in the table below.

| Evaluation FY | Points identified in evaluation of Board of Directors' effectiveness | Main responses to points identified |

|---|---|---|

| FY2014 | Diversification of Board of Directors' members | Financial accounting expert is appointed to outside directors |

| Strategy/plan discussion enhancements | Established Outside Directors' Committee, attended by executive team, to discuss the Medium-Term Management Plan | |

| FY2015 | Sharing of fiscal year plans, etc., with executive team | At Outside Directors' Committee, executive team explains outside director-selected themes and discusses them among outside directors |

| Enhanced explanations of risk-related agenda items | Increased number of issues to discuss and expanded reports at Board of Directors' meetings, enhanced prior explanations, glossaries distributed | |

| FY2016 | Strategy/plan discussion enhancements | More exchanges of opinion and discussions with outside directors when formulating the new Medium-Term Management Plan |

| Clarification of role of Board of Directors' meetings | Executive training by external instructors/Training at Outside Directors' Committee | |

| Diversification of Board of Directors' members | Appointed new outside director with extensive international experience/wealth of experience and achievements in financial field | |

| Improving understanding of agenda items (financial expertise) | Glossary creation, preliminary explanation of risk-/regulatory-related matters by officers/managers in charge | |

| FY2017 | Sharing requests from institutional investors, etc. | Requests/discussions from investors/analysts reported at Board of Directors' meetings |

| Discussion of potential future risks, etc. | Business continuity plans (BCPs) discussed with outside directors | |

| Oversight of medium-term/annual plans | Status reports on Group numerical targets (quarterly) and departmental KPIs (half-yearly) | |

| Arrangement of succession plans | Status of development of successor candidates reported at Board of Directors' meetings | |

| Clarification of issues in meeting materials | Improved documentation, including composition of materials | |

| FY2018 | Sharing requests from institutional investors, etc. | In addition to reporting at the Board of Directors' meetings, sharing of external evaluations on a quarterly basis |

| Discussion of potential future risks, etc. | Sharing awareness of outside directors' role about compliance | |

| Discussions on the SDGs | Development of the SDGs promotion system and progress status reported at Board of Directors' meetings | |

| Governance system expansion | Establishment of official regulations for regular reviews of future CEO candidates and expansion of reporting from affiliated subsidiaries | |

| FY2019 | Enhanced support for outside directors | Establishment of Corporate Secretariat Office Established Corporate Governance Guidelines and reconfirmed roles Outside directors Outside directors' participation in discussions on new Medium-Term Management Plan from outset Increased opportunities for exchanges of opinions at Outside Directors' Committee and between outside directors and internal directors and responsible officers |

| Strengthening of Group governance | Strengthening of reporting on important risk-taking by Group companies and governance of overseas bases | |

| Expansion of discussions on important issues | Confirmed customer-centric business operations, SDGs/ESG initiatives, and COVID-19 response, actively discussed DX and potential future risks | |

| FY2020 | Strengthening Monitoring of Medium-Term Management Plan | Formulated the Board of Directors' annual agenda plan, held discussions based on reports by presidents of the Group's major companies, and secured more time for discussion |

| Strengthening Risk Monitoring | Held interviews with all directors regarding Top Risks, revised the scope and definition of Top Risks (included climate change and geopolitical risk starting with the FY2022 Risk Appetite Statement), monitored important investment projects, and discussed cybersecurity | |

| Continue discussions regarding the SDGs/ESG, etc. | Formulated and revised the Environmental and Social Policy Framework, finalized the Daiwa Securities Group Net Zero Carbon Declaration, and discussed human capital | |

| FY2021 | Monitoring the Medium-Term Management Plan | Continued to formulate the annual agenda plan for the Board of Directors and monitor the Medium-Term Management Plan, including reports from presidents of the major subsidiaries owing to positive assessment by directors |

| Strengthening risk monitoring | Continued to hold interviews with all directors regarding Top Risks (including climate change and geopolitical risks, as before) Discussed geopolitical risks at the Outside Directors' Committee and at off-site meetings, and discussed cybersecurity at the Board of Directors |

|

| Continue discussions regarding sustainability | Held question and answer sessions regarding revisions to the environmental and social policy framework, ESG evaluation response, and TCFD disclosure content plan | |

| Others | Determined the human rights policy and discussed the human capital disclosure plan Reduced and streamlined time spent on explanations at the Board of Directors using prior explanations and videos |

|

| FY2022 | Discussion toward the formulation of the Medium-term management plan (including further deliberation on management that is conscious of capital cost and stock price) | Formulated following preliminary discussions on the Group's Basic Management Policy—"Maximize Customer Asset Value"—and human resources strategy at the Outside Directors' Committee, and five rounds of deliberation at the Board of Directors. "Vision 2030" was also revised. Deeper discussions were held regarding management practices that are conscious of capital cost and stock price. |

| Strengthening risk monitoring | Continued to hold interviews of all directors regarding Top Risks (including climate change, geopolitical risks, and the addition of AI-related misinformation and disinformation as top risks). Report to the Board of Directors on the formulation of AI Governance Mission Statement, the establishment of an AI Governance Committee, and the enhancement of cybersecurity control and management framework. Discussion at the Outside Directors' Committee on "Geopolitical Risks and Crisis Management in Financial Capital Markets." Discussion at the Offsite Meeting on AI risk management. |

|

| Continue discussions regarding sustainability | In addition to discussions toward the formulation of the Medium-term management plan, the following actions were carried out: Revision of the environmental and social policy framework, Establishment of interim targets for GHG emissions in the investment and loan portfolio, and Reporting on ESG rating responses and proposed disclosures under TCFD. | |

| Others | Continue to use prior explanations and videos to reduce explanation time during Board of Directors meetings and ensure more time for the discussion of important agenda items. |

- Note:Please refer to the Corporate Governance Report for the comments and responses from the FY2023 evaluation, as well as the comments from the FY2024 evaluation

Preventing Conflict-of-Interest Transactions between Group Companies

Conflict-of-interest transactions can occur between Daiwa Securities Group Inc. and Group companies in situations such as intra-Group transactions. Daiwa Securities Group applies rules regarding conflicts of interest stipulated by Japan's Companies Act to the Executive Management Committee as well as the Board of Directors. Conflicts of interest between Daiwa Securities Group Inc. and Group companies are appropriately prevented through a rule prohibiting an executive officer from voting when he or she concurrently serves as an officer of an interested Group company and thus has a special interest in a matter to be decided.

Performance -linked remuneration system for Directors and Corporate Executive Officers (Shikkoyaku)

At Daiwa Securities Group, Inc., as stipulated by the Companies Act, the Compensation Committee has determined "Policies for Determination of Remuneration of Directors and Corporate Executive Officers."

Policies for Determination of Remuneration of Directors and Corporate Executive Officers

Compensation for Directors and Corporate Executive Officers is based on the following fundamental policies.

- To create effective incentives, which contribute to the increase of shareholders' value through sound business development and also lead to the improvement of business performance in the short-term and in the medium/long-term.

- To maintain a remuneration level which is competitive enough to recruit and retain people not only in Japan but also in the world as a global securities company group.

- To ensure the execution and supervision functions operate effectively as a company with a nominating committee, etc.

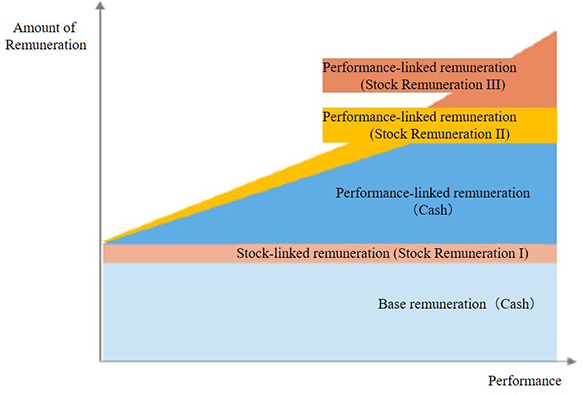

Remuneration of Directors and Corporate Executive Officers consists of base remuneration, Performance-linked remuneration and Stock-linked remuneration, and determined at the Compensation Committee which are specifically as below.

- Base remuneration

- A fixed amount calculated based on his/her position, duties and role, and paid monthly and in cash.

- Stock-linked remuneration

- To increase the link between remuneration and shareholders' value, the Company grants, as stock-linked remuneration, restricted stock, etc., the value of which corresponds to a certain percentage of base remuneration, as non-monetary remuneration at a certain time every year.

- Performance-linked remuneration

- Determined depending on the level of individual contribution, mainly on the basis of consolidated ROE, consolidated ordinary income and base income, which are settled as Performance KPIs of the Medium-Term Management Plan, while also comprehensively taking into account achievement status of the managerial goals set in the Medium-Term Management Plan and other relevant factors, and paid annually at a fixed time in the form of cash and restricted stocks.

- A certain limit is set for the cash payment regarding performance-linked remuneration based on business performance. If performance-linked remuneration exceeds the limit, the part exceeding the limit will be replaced from cash to restricted stock.

- It does not apply to Directors who do not serve as Corporate Executive Officers.

- (Note)Base Income: Total ordinary income from wealth management, securities asset management, and real estate asset management.

Regarding remuneration, etc. of Directors and Corporate Executive Officers (Shikkoyaku) for the current fiscal year, the Compensation Committee has determined that the remuneration, etc. conforms with "Policies for Determination of Remuneration of Directors and Corporate Executive Officers" because such remuneration, etc. was decided by the Compensation Committee only after confirming its consistency with such policies.

< Performance-linked remuneration >

The Company refers to KPIs, which are set as the Group numerical goals in the Medium-Term Management Plan "Passion for the Best" 2026 to calculate Performance-linked remuneration.

The performance assessments used in calculating Performance-linked remuneration reflect the financial performance evaluation, which is based on the Performance KPIs using the financial information and the quality evaluation, which is a comprehensive assessment of the KPIs other than the Performance KPI. The Financial Performance Evaluation and the Quality Evaluation are determined by the Compensation Committee.

Performance-linked remuneration is calculated by multiplying the reference amount determined for each position by the performance evaluation, and reflecting the degree of individual contribution. The same calculation formula is applied to all positions for performance evaluation.

The indicators pertaining to Performance-linked remuneration are as shown below.

| Financial Performance Evaluation (100) |

± | Quality Evaluation (-20 - +20) |

|||||

|---|---|---|---|---|---|---|---|

| Category | KPI | Points | Reference Value | KPI | Reference Value | Actual value | |

| Performance | Consolidated ROE | 40 | 10% | 9.8% | |||

| Consolidated Ordinary Income | 40 | 240 billion yen | 224.7 billion yen | ||||

| Base income | 20 | 150 billion yen | 137.5 billion yen | ||||

| Customer asset | AUM | 120 trillion yen | 90.2 trillion yen | ||||

| Stock-related asset | 13.6 trillion yen | 9.8 trillion yen | |||||

| AUM in AM Division | 44 trillion yen | 34.9 trillion yen | |||||

| Digital | Number of digital value creation projects | 10 | 2 | ||||

| Number of trial digital projects | 50 | 45 | |||||

| Sustainability | SDG-related bond league table | In top 2 | 1st | ||||

| Engagement Survey score | 80% or higher | 81% | |||||

| GHG emissions produced by the Company | FY2030 Net zero | - | |||||

| GHG emissions from investment and loan portfolio | 186〜255g-CO2/kWh | - | |||||

- (Note) The standard value is determined at the Compensation Committee, based on the target of the Medium-term Management Plan.

< Image of Remuneration >

- Restricted stocks and phantom stocks in a value corresponding to a certain ratio of performance-linked remuneration (cash) are paid to foster a system that increases incentivizes for long-term performance improvement and sustainable growth.

- In order to foster a system that increases incentivizes for long-term performance improvement and sustainable growth, if Performance-linked remuneration exceeds a certain limit, the excess amount will be paid in the form of phantom stocks.

< Stock Compensation Plan >

The Company introduced the Stock Compensation Plan to increase incentives for the Company and its subsidiaries' Directors, Corporate Executive Officers (Shikkoyaku), and Executive Officers (Shikkoyakuin), etc., to enhance performance in the medium and long term and strengthen values shared among the Eligible Officers, etc. and shareholders.

| Stock-linked remuneration (RS I) |

It is intended to provide restricted stock (RS I) for amount which equals to fixed ratio of the Base remuneration, and to function effectively as an incentive for long-term performance improvement, restriction will be released when he/she resigns his/her position as director, officers etc., of the Company and its subsidiaries and affiliates. |

|---|---|

| Performance-linked remuneration (RS II) |

Performance-linked remuneration is paid in the form of restricted stocks (RS II) of a value corresponding to a certain percentage of performance-linked remuneration (cash). The restricted transfer period is approximately three years, which functions both as an incentive to boost long-term performance and to defer actual compensation. |

| Performance-linked remuneration (PS) |

Performance-linked remuneration is paid in the form of phantom stocks (PS) of a value corresponding to a certain percentage of performance-linked remuneration (cash). Additionally, if the performance-linked remuneration exceeds a certain limit, the excess amount will be paid in the form of phantom stocks. Phantom stocks are a cash-settled remuneration system linked to the Company's stock price. The holding period is approximately three years, which functions both as an incentive to boost long-term performance and to defer actual compensation. |

- (Note 1)RS II is calculated by multiplying the ratios established by position by performance-linked remuneration (cash).

- (Note 2)PS is calculated by applying a uniform percentage to performance-linked remuneration (cash), regardless of position. Regarding the President and CEO, a structure is in place to decide the ratio of performance-linked remuneration based on the Company's TSR (total shareholder return) during the results evaluation period, the rate of change of the TOPIX, and a comparative valuation with the TSR of competitors.

- (Note 3)Where serious compliance violations are discovered within the Group, in addition to the forfeiture of unpaid stock remuneration (malus), based on deliberation by the Compensation Committee, a clawback scheme is being introduced to allow the Company to demand the return of all or part of the stock remuneration that has already been paid.

< Procedures on decision of remuneration for Directors >

For details on the procedures on decision of remuneration for Directors, etc., please see below.

< Consolidated Compensation, etc. by officer >

For details on Consolidated Compensation, etc. by officer, please see below.

Internal Control System and Internal Audit

The Company group has created management structure centered on the Company with regard to the group's various main risks, and seeks to ensure the effectiveness and efficiency of operations, the reliability of the finance report, compliance with the laws and regulations concerning business operations, and the preservation of assets, etc. This is based on the recognition that the maintenance of the internal control system to accomplish the sound and appropriate operation is the responsibility of the manager.

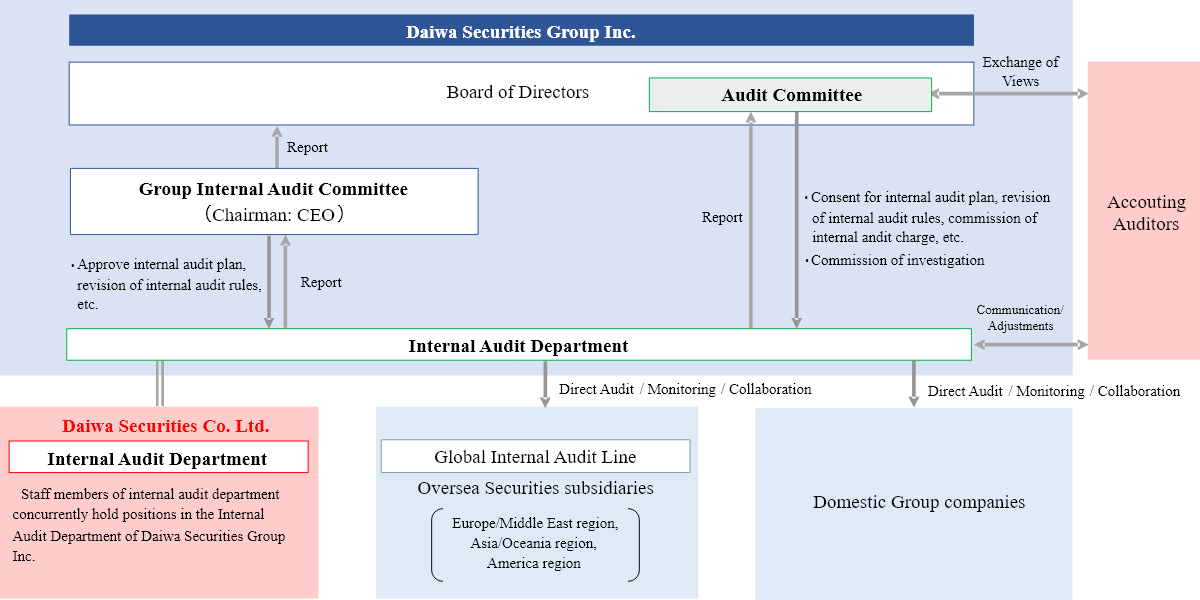

Based on the recognition that the establishment of a sound and efficient internal audit system enhances the value of the Group, and having concluded that the internal audit plays an important role in such a system, the Company has positioned a full-time Internal Audit Corporate Executive Officer (Shikkoyaku) in charge, and has an Internal Audit Department, which is independent from other sections, verify the internal control system.

By conducting risk-based audits, the Department strives to enhance the Group's corporate value.

Focus items in the internal audits of the Group's

- The state of internal control at Daiwa Securities and overseas locations as a global financial instruments business operator

- The state of businesses at Group companies, and the state of control from the Company

Authorization of Plans and Reporting of Results

Internal audit plans are subject to approval by and results of the audits are presented to the Group Internal Audit Committee. Furthermore, internal audit plans shall be consented to by the Audit Committee or the Selected Audit Committee Members who has been given certain authority from the Audit Committee, and the results of the audits are also reported directly to the Audit Committee.

Collaboration with Parties Inside and Outside the Group and Improvement of System

The Company's Internal Audit Department collaborates with the internal auditing divisions of major Group companies in Japan and overseas through regular meetings, monitoring, and audit activities.

The Company's Internal Audit Department is in close liaison with the Audit Committee and Accounting Auditors and make adjustments with them in order to carry out auditing efficiently. The Department may also be delegated investigative duties from the Audit Committee. The degree to which these internal auditing activities satisfy the "International Standards for the Professional Practice of Internal Auditing," established by the Institute of Internal Auditors, is routinely evaluated by independent outside third parties. The Group thus strives to constantly improve its system.

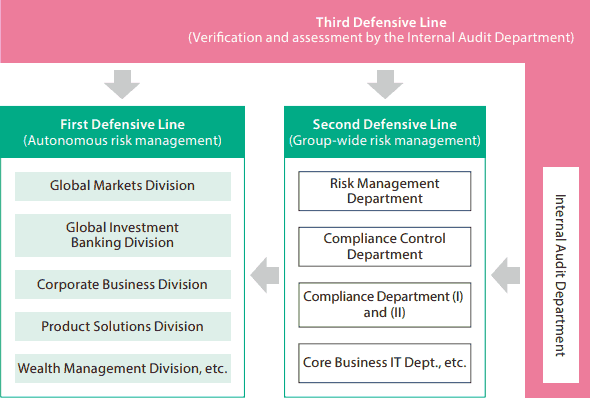

Three Defensive Lines

In order to establish an effective risk governance system, the Group has created guidelines for Three Defensive Lines and a comprehensive structure for risk management. The First Defensive Line is front offices, where various operational risks are identified and managed autonomously. The Second Defensive Line is Group-wide risk management, which is conducted mainly by the risk management and compliance departments. The Internal Audit Department constitutes the Third Defensive Line by verifying and evaluating whether or not the other two lines of defense are functioning effectively.

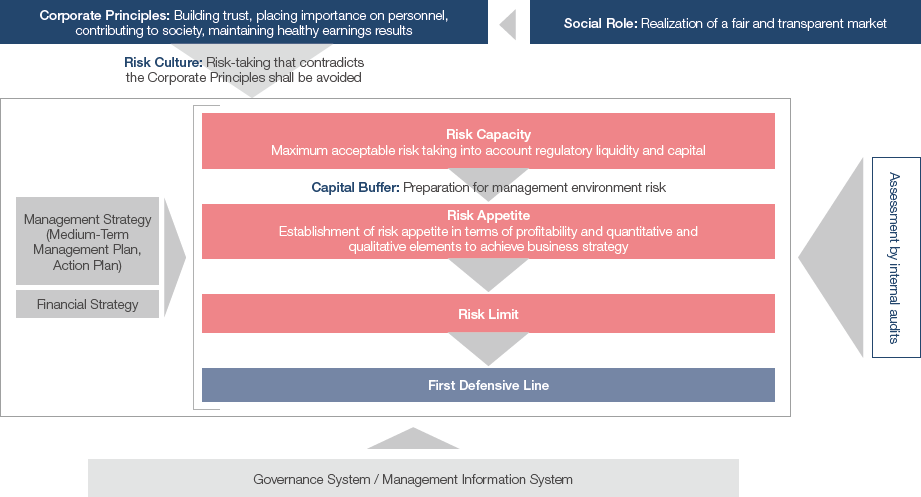

Risk Appetite Framework

Globally operating financial institutions are required to ensure that they are sound enough to adequately perform their financial intermediation function even in times of economic or market stress. Additionally, to be well prepared for stress, they need to secure sufficient liquidity and capital for risks even in ordinary times.

Under these circumstances, the Group has introduced the Risk Appetite Framework (RAF). The Group's RAF is documented as the Risk Appetite Statement and deliberated and decided at the Board of Directors. The Group is making efforts to instill it within the Group and improve the management structure.

Quantitative indicators of risk appetite are deliberated and decided as part of the Risk Appetite Statement and reviewed twice a year at the Board of Directors. The Audit Committee audits RAF-related execution of duties by the Board of Directors and the management.