5. Risk Management

(1) Climate-related Risk Management

① Overview of Risk Management

While the Group pursues profitability and growth, it also recognizes the importance of appropriately identifying, evaluating, and effectively managing various risks associated with its business operations. We are working to continuously improve our corporate value by maintaining a sound financial structure and earnings structure that properly balances risk and return and by appropriately managing risks that could materialize not only in the short term, but also in the medium to long term, such as climate-related risks.

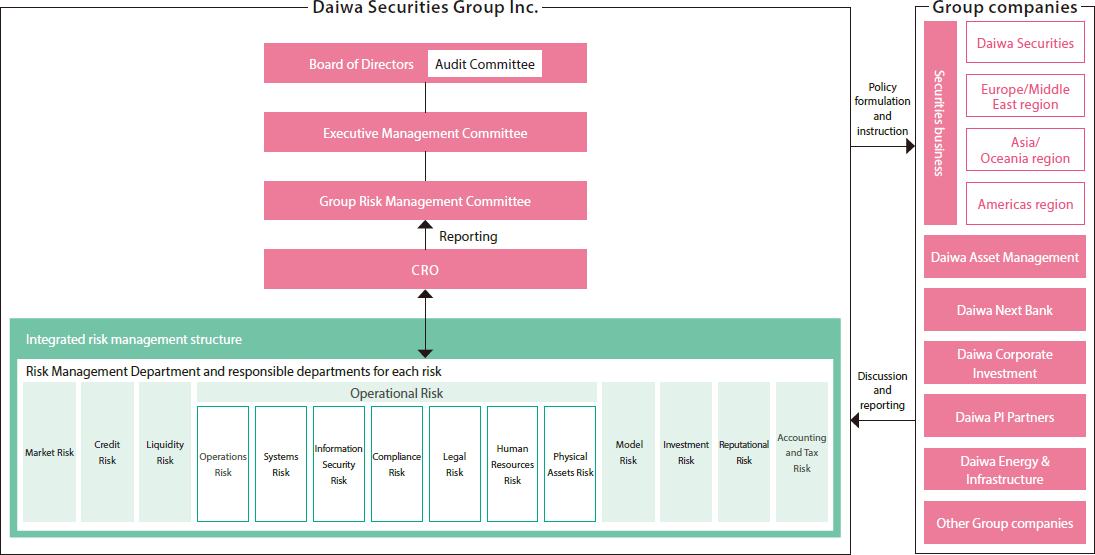

Risk Management System

Climate-related risks include not only climate phenomena, but also factors such as political and social responses and economic structures, which all interrelate. For example, the transition process to a decarbonized society includes effects to stocks and interest rates with changes in the overall economy (market risk). The transition also will affect the business and financial conditions of companies responding to climate change (credit risk), meaning climate-related risks could be a factor in inducing or increasing various existing risks. As such, we consider the effects of climate-related risks in our existing risk management framework. The definitions and management processes of various risks are as follows.

Market Risk

Market risk refers to the risk of incurring losses due to market fluctuations, which affect the value of stock prices, interest rates, foreign exchange rates, and commodity prices. In terms of the Group's trading business, by providing market liquidity the Group acquires compensation while at the same time taking on market risk through the holding of a certain amount of financial assets. The Group implements suitable hedges to curtail fluctuations in profits and losses. However, as hedges may fail to function effectively in times of stress, the Group sets limits on Value at Risk (VaR)*1 and loss estimates under various types of stress test*2 to ensure that they are within the scope of equity capital, after taking into consideration financial conditions and such factors as the business plans and budgets of subject departments. The Group also sets limits on such facets as position and sensitivity.

The departments in charge of the Group's trading services calculate positions and sensitivity for the purpose of assessing their own market risk, and monitor such. Meanwhile, risk management departments also monitor the status of market risk, confirm whether risk falls within the established limits, and report on such to management on a daily basis.

In addition, we conduct stress tests using shortened NGFS scenarios to assess the impact of climate-related risks on trading positions and will continue to refine our approach as necessary.

- *1Value at Risk (VaR) represents the maximum possible loss of a given trading portfolio with a given probability over a given time horizon.

- *2Stress tests are used to calculate the Group's maximum losses based on scenarios of the most significant market fluctuations of the past and due to scenarios based on hypothetical risk events.

Credit Risk

Credit risk refers to the risk of losses caused in cases where a counterparty of a trade or the issuer of a financial product held by the Group suffers a default, or credibility deteriorates. The credit risk of the Group's trading activities involves counterparty risk and issuer risk.

As far as counterparty risk is concerned, the Group assigns an upper allowable credit amount for each counterparty group and monitors it on a regular basis. We also monitor the volume of risk for the issuer risk of financial instruments held for market-making.

Because the Group provides financial instruments, manages assets and makes investments, the Group is exposed to the risk that various instrument and transaction exposures concentrate on a specific counterparty. If the counterparty's credit situation worsens, the Group may incur significant losses. Therefore, the Group has established the upper limit on total exposure to any counterparty and periodically monitors such limit.

We will continue to enhance the assessment of climate-related risks associated with our exposure.

Operational Risk

Operational risk is the risk of losses that occur when internal processes, people, and systems do not perform adequately or do not function; it can also arise from external events.

The Group classifies operational risks into the seven categories of operations risk, systems risk, information security risk, compliance risk (including conduct risk), legal risk, human resources risk, and physical assets risk, and monitors them by assigning departments responsibilities for individual risk.

Also, we have formulated a BCP to prioritize the resumption and continuation of critical operations in the event of disruptions caused by earthquakes, fires, wind and flood damage, abnormal weather, terrorism, large-scale blackouts, or major infectious diseases affecting our headquarters, branches, or data centers. This plan ensures the safety of customers and employees, asset protection, and the continuation of essential operations*. Specifically, we have established a top-tier backup center and a system to maintain critical operations at alternative offices if headquarters functions are disrupted. In Addition, when developing new products, we assess their appropriateness from an ESG perspective.

- *The essential operations include: (1) Market settlement of already contracted but unsettled transactions, (2) Withdrawal operations, (3) New order processing for selling and redeeming products (domestic listed stocks, MRF, government bonds for individuals, and ordinary deposits), and customer orders for selling and covering margin trades.

Reputational Risk

Reputational risk refers to the possibility of the Group sustaining unforeseen losses and the Group's counterparties being adversely affected due to a deterioration of its reliability, reputation, and assessment caused by the spread of rumors or erroneous information. There are no uniform procedures for managing reputational risk because it can emanate from a variety of sources.

The Group has established various regulations under its Disclosure Policy, with particular emphasis on the management and provision of information. It has also set up the Disclosure Committee within Daiwa Securities Group Inc.

Each Group company is obligated to report information that could turn into reputational risk to the Disclosure Committee. That way, Daiwa Securities Group Inc. can obtain and centrally manage information, and it disseminates accurate information in a prompt manner according to the decisions of the Disclosure Committee.

The Group strives to keep abreast of problems and occurrences that may affect its reputation so that if and when such problems occur, their impact on the Group can be minimized. It also acts to ensure that erroneous and inaccurate information is properly corrected, and that it responds appropriately to libel and other issues. The Group has public relations and investor relations systems in place to prevent and minimize risks regarding its reputation.

We will continue to advance the analysis of potential impacts of climate-related risks on our reputation.

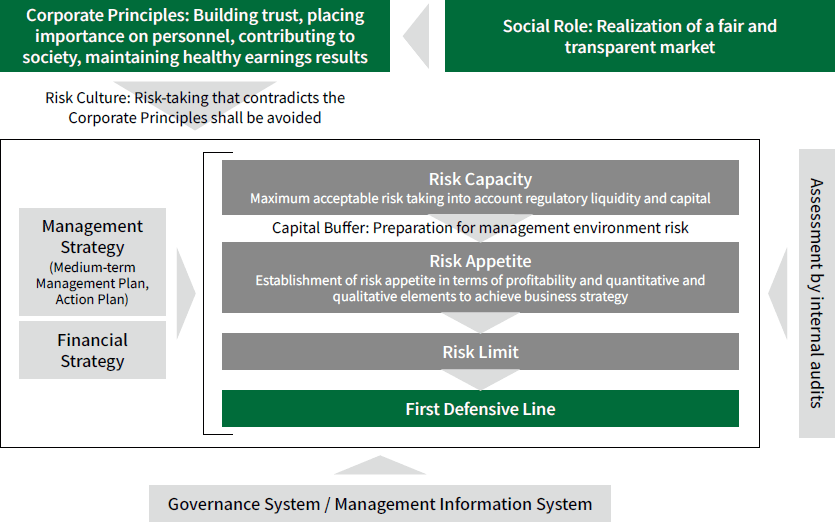

② Climate-related Risks in the Risk Appetite Framework

Globally active financial institutions are required to ensure sufficient soundness to exercise their financial intermediary capabilities even in times of economic or market stress. In addition, the Group is required to ensure it has more sufficient liquidity and equity capital commensurate with these risks than usual in order to be adequately prepared during times of stress. Under this environment, the Group has introduced a risk appetite framework (RAF). The Group's RAF has been documented in our Risk Appetite Statement, which the Board of Directors has deliberated and decided on, and we are working to spread this Group-wide while raising the level of its management system. The quantitative risk appetite index is a topic of discussion and determination by the Board of Directors as part of the Risk Appetite Statement and reviewed twice yearly. RAF-related audits of the Board of Directors and management business execution are conducted by the Audit Committee.

Climate-related risks have been included in this statement since FY2021. With this inclusion, climate-related risks are properly identified, assessed, and effectively monitored based on their risk profile.

RAF Concept Chart

(2) Environmental and Social Policy Framework

To strengthen our management system for environmental and social risks, including preserving the global environment and biodiversity and protecting human rights, the Group has formulated the Environmental and Social Policy Framework. This framework covers new investments, loans, and underwriting of bonds and stocks issuance and defines businesses for which the financing is prohibited and restricted.

When providing new financing, we carry out initial ESG due diligence on the eligible projects. If it is deemed that additional confirmation is required as a result of the assessment, enhanced ESG due diligence is implemented to determine whether or not to provide financing. Where carrying out the project in question could risk severely damaging the Group's corporate value, additional discussions are held by the executive management to make a final decision on financing.

Furthermore, even after executing new investments and loans, we conduct regular screening for child labor, forced labor, and human trafficking at our investees and lenders.

If such practices are identified, we demand through dialogue that they are corrected and their recurrence prevented, and we carefully consider whether to continue investment. This framework will be reviewed regularly based on trends in Japan and overseas.

Revision of Environmental and Social Policy Framework

| Date | Summary |

|---|---|

| June 2021 | Formulated the Environmental and Social Policy Framework. |

| December 2021 | Expanded the scope to underwriting of bond and equity issuances. |

| December 2022 | Tightened policies on palm oil plantation development projects, deforestation-related projects, coal mining projects, and oil & gas development projects. |

| December 2023 | Tightened policies on human rights and supply chain management. |

| December 2024 | Strengthening of coal mining policy and enhancement of human rights practices. |

Summary of Environmental and Social Policy Framework (Climate Change)

| Restricted Business | Policies |

|---|---|

| Coal-fired power generation | We prohibit any financing where the use of proceeds is directed toward the new construction of coal-fired power generation and the expansion of existing facilities. Regarding the underwriting of bonds and stocks issuance, however, issuers that announce a target for net zero GHG emissions by 2050, or businesses adopting new technology aligned with the goals of the Paris Agreement, may be considered on a case-by-case basis. |

| Palm oil plantation development | When providing financing to a business, we will carry out ESG due diligence, carefully assessing whether the loss of wildlife habitat due to overdevelopment may lead to a loss of biodiversity, or land conflicts with indigenous residents, or human rights violations such as child labor/forced labor/human trafficking, or whether appropriate measures are taken to prevent them. We will utilize these results in making decisions. When providing financing to a business, we will confirm if RSPO (Roundtable on Sustainable Palm Oil), an international certification system for palm oil, has been acquired. Where this is not in place, we will encourage our clients to obtain certification. We will encourage our clients to make environmental and human rights policies such as NDPE (No Deforestation, No Peat and No Exploitation) or other compatible policies. Regarding new investments and loans, we will encourage our clients to enhance their supply chain management and traceability to ensure that similar initiatives will also apply to their supply chain. |

| Business involving deforestation | When providing financing to a business, we will carry out ESG due diligence, carefully assessing whether appropriate measures will be taken to prevent a negative impact on the environment caused by the destruction of ecosystems, and whether illegal logging is carried out. We will utilize these results in making decisions. When providing financing to a business, we will encourage our clients to obtain FSC (Forest Stewardship Council), an international forest certification system or other compatible certifications or to make environmental and human rights policies such as NDPE or other compatible policies. Regarding new investments and loans, we will encourage our clients to enhance their supply chain management and traceability to ensure that similar initiatives will also apply to their supply chain. |

| Coal mining | We prohibit any financing where the use of proceeds is directed toward projects using the mountaintop removal (MTR) method, the new development of thermal coal mining, the expansion of existing thermal coal mining and the new development and expansion of infrastructure dedicated to thermal coal mining. Regarding the underwriting of bonds and stocks issuance, however, issuers that announce a target for net zero GHG emissions by 2050 may be considered on a case-by-case basis. When providing financing to a business, we will carry out ESG due diligence, carefully assessing whether appropriate measures are taken to ensure occupational safety and a sanitary environment to prevent cave-in accidents, flood accidents, gas explosions, and human rights violations such as illegal labor. We will utilize these results in making decisions. |

| Large-scale hydroelectric power generation construction | When providing financing to a business, we will carry out ESG due diligence, carefully assessing whether appropriate measures will be taken against the destruction of the environment and ecosystems and negative impacts on local residents due to the construction of a dam. We will utilize these results in making decisions. |

| Oil and gas development | When providing financing to a business, we will carry out ESG due diligence, carefully assessing whether appropriate measures are taken against their impact on the environment, ecosystems and local communities. We will utilize these results in making decisions. In particular, we will make careful decisions when providing financing to development businesses in the Arctic, oil sands and shale oil and gas development businesses, pipeline businesses which may have significant negative impacts on the environment and society. |