3. Governance

(1) Board's Oversight

The Board of Directors oversees a response to strategies and policies related to sustainability, including climate change. The Board of Directors receives reports as needed in accordance with the rules of the Board of Directors on strategies and policies related to sustainability discussed at the Sustainability Promotion Committee or deliberated on by the Executive Management Committee. Additionally, the Board of Directors makes resolutions on items that are core management matters and items deemed important by the Board of Directors established as resolution items in the rules of the Board of Directors.

The Group's Vision 2030 includes our basic sustainability policy, and this was decided at the Board of Directors together with the Medium-term Management Plan. In addition, thus far, the Board of Directors has determined, for example, the formulation or revision of the Environmental and Social Policy Framework and the Net Zero Carbon Declaration.In our risk appetite statement, starting in FY2021, we stipulated climate change risk, and have appropriately identified, assessed, and effectively managed climate change based on the estimated amount of losses from scenario analysis.

In FY2023, the Board of Directors decided on the Medium-term Management Plan "Passion for the Best" 2026 (including revisions of Vision 2030). In this plan, sustainability topics, including climate change, were also raised. The sustainability KPI in the Medium-term Management Plan has been confirmed at a subsequent Board of Directors meeting at the time financial results were approved and the Medium-term Management Plan was reviewed. Additionally, at FY2024 Board of Directors meetings, a total of four items were given: a report on climate-related disclosures, a resolution to revise the Environmental and Social Policy Framework, a report on the state of the promotion of sustainability, and a report for institutional investors from the sustainability meeting*.

To strengthen executives' incentives related to sustainability initiatives, we have incorporated the sustainability KPIs in the evaluation system for performance-linked remuneration. These KPIs include the SDGs bond league table and GHG emissions. For details, please refer to "6. Metrics and Targets (4) Executive Remuneration".

- *In October 2024, a sustainability meeting was held for institutional investors and sell-side analysts, where the Head of Sustainability, Outside Director, CHO, and CFO gave presentations, sharing the Group's policies, KPI progress, and initiatives related to disclosure, governance, and human capital.

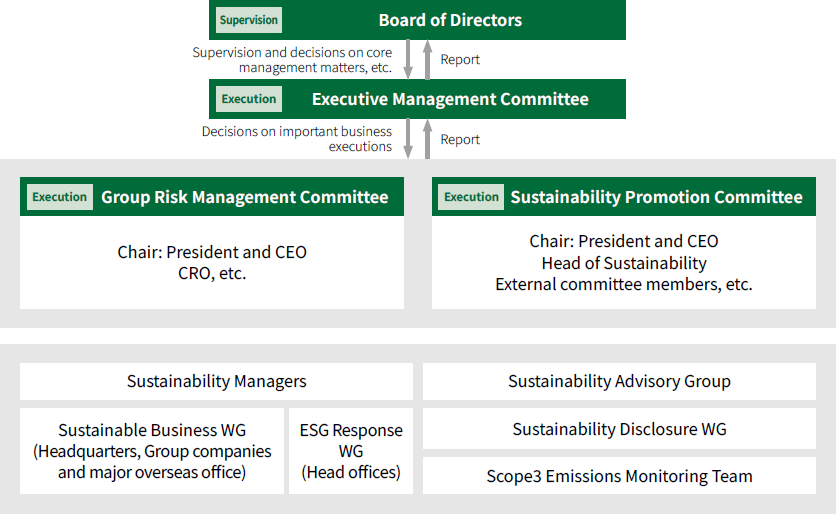

Governance Structure for Climate Change

Comments from Outside Directors

Climate-related Disclosures

- It is important to consider future directions by identifying gaps with disclosure standards and peer practices.

Environmental and Social Policy Framework

- Conducting objective and detailed due diligence, including investees' supply chains, remains a challenge.

Roles and Discussion Topics of Each Committee

| Committee | Members | Roles | Discussion Topics | |

|---|---|---|---|---|

| Supervision | Board of Directors | Chair: Chairperson of the Board Outside Directors: 7 Internal Directors: 7 |

|

|

| Nominating Committee | Chair: Outside Director Outside Directors: 5 Internal Directors: 2 |

|

|

|

| Audit Committee | Chair: Outside Director Outside Directors: 4 Internal Directors: 1 |

|

|

|

| Compensation Committee | Chair: Outside Director Outside Directors: 5 Internal Directors: 2 |

|

|

|

| Execution | Executive Management Committee | Chair: President and CEO |

|

|

| Group Risk Management Committee |

Chair: President and CEO |

|

|

|

| Sustainability Promotion Committee |

Chair: President and CEO Internal members: 16 External members: 3 |

|

|

|

Skills Matrix of the Board of Directors

There are Internal and Outside Directors with deep knowledge of sustainability on the Board of Directors, with a system in place to provide highly effective oversight of initiatives toward sustainability-related issues. In addition, a skills matrix has been developed based on discussions by the Nominating Committee to evaluate directors' expertise and experience. For Sustainability, relevant experience, including roles promoting the Group's sustainability strategy, is considered.

| Name | Role | Years on Board | Expertise and Experience | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Corporate Management |

Finance/ Accounting |

Legal/ Compliance |

DX/ICT | Global | Sustainability | ||||||

| Seiji Nakata | Nominating | Compensation | 10 | They have expertise and experience to adequately manage and control the Group. |

● | ||||||

| Akihiko Ogino | Nominating | Compensation | 5 | ● | |||||||

| Shinsuke Niizuma | 1 | ||||||||||

| Keiko Tashiro | 11 | ● | ● | ||||||||

| Eiji Sato | 1 | ||||||||||

| Hiroko Sakurai | - | ||||||||||

| Sachiko Hanaoka | Audit | 6 | |||||||||

| Eriko Kawai |

Outside Non-executive |

Nominating | Compensation | 7 | ● | ● | ● | ||||

| Katsuyuki Nishikawa |

Outside Non-executive |

Nominating | Audit | 6 | ● | ● | |||||

| Toshio Iwamoto |

Outside Non-executive |

Nominating | Compensation | 5 | ● | ● | ● | ● | |||

| Yumiko Murakami |

Outside Non-executive |

Audit | Compensation | 4 | ● | ● | ● | ||||

| Noriko Iki |

Outside Non-executive |

Nominating | Audit | 2 | ● | ● | ● | ||||

| Mami Yunoki |

Outside Non-executive |

Audit | Compensation | 1 | ● | ● | |||||

| Akira Ichikawa |

Outside Non-executive |

Nominating | Compensation | - | ● | ● | ● | ||||

- OutsideOutside Director

- Non-executiveIndependent Director as defined by the stock exchange

(2) Execution Framework

① Sustainability Promotion Committee

Regular discussions are held at the Sustainability Promotion Committee chaired by the President and CEO on strategies and policies related to sustainability, including climate change.

For example, the Committee has discussed the formulation or revisions of the Environmental and Social Policy Framework and the Net Zero Carbon Declaration.

The Committee is composed of the Head of Sustainability, who is responsible for promoting sustainability based on the rules for Corporate Executive Officers (Shikkoyaku) approved by the Board of Directors, several Internal Directors, and three external experts with specialized knowledge in sustainability. The details of discussion at the Committee are reported to, deliberated on and determined at the Executive Management Committee, as appropriate.

Sustainability Expertise of External Experts

| Name | Affiliation/Job Title | Expertise |

|---|---|---|

| Toshihide Arimura |

|

|

| Arisa Kishigami |

|

|

| Daisuke Takahashi |

|

|

Comments from External Experts

Climate-related Disclosures

- Sharing challenges in adopting ISSB and SSBJ standards within Japan would help raise overall disclosure quality.

- To enhance credibility, it would be helpful to clarify the specific skills behind the skills matrix.

- Rather than focusing on disclosure, more emphasis should be placed on addressing risks and capturing opportunities. It is recommended to clearly expected risks and opportunities along with related initiatives and KPIs.

Revision of Environmental and Social Policy Framework

- With global expectations rising, proactive action on human rights and environmental due diligence is essential.

- It is important to detect risks through engagement, at the same time, practical and realistic measures should be considered, such as collecting information efficiently by country, region, or industry, and promoting collaborative engagement targeting specific sectors.

② Group Risk Management Committee

Policies and measures relating to risk management, including climate change, are discussed at the Group Risk Management Committee chaired by the President and CEO, a subcommittee of the Executive Management Committee, and attended by the Chief Risk Officer (CRO), who is responsible for risk management.

After climate scenario-based quantitative analysis results are reported to the Group Risk Management Committee each year, they are reported to the Executive Management Committee based on discussion at the Sustainability Promotion Committee.

③ Group-wide Working Group

As a Group-wide system to promote sustainability, we have appointed Sustainability Managers at each division and major Group company. Under these managers, a working group (WG) monitors sustainability KPIs and promotes sustainability-related businesses. The contents of the discussion of this WG are reported to the Sustainability Promotion Committee as appropriate.

Group-wide Working Group

| WG | Summary |

|---|---|

| Head of Sustainability | Promote sustainability-related businesses for the entire Group, and oversees initiatives to enhance the foundation for sustainable management. |

| Sustainability Managers | Promote sustainability-related businesses and conduct KPI progress management for each organization (Headquarters and Group companies) within the Group. |

| Sustainable Business WG | Monitor the KPIs, ascertain the progress status of sustainability-related businesses, identify issues, and plan and implement measures for these issues under the direction of sustainability managers. |

| ESG Response WG | Enhance and strengthen ESG response in reference to external evaluations (investors and evaluation organizations) regarding ESG. |

| Sustainability Advisory Group | Composed of internal experts with extensive knowledge in sustainability who make proposals regarding challenges for the Group and future action. |

| Sustainability Disclosure WG | Cross-departmental organizations that aim to expand the disclosure of sustainability information from the perspective of integrated reporting. |

| Scope3 Emissions Monitoring Team | Monitor emissions relating to the investment and loan portfolios, and sets targets. |