Support for Asset Building: Maximizing the Value of Customer Assets

In each of its business domains, Daiwa Securities Group is contributing to maximizing the value of customer assets as well as the corporate value of customers on a medium- to long-term basis by providing them with high-quality solutions that are both optimal to meet their needs and suited to the current economic environment.

Products offered to pursue shared value

Initiatives through Business Activities Such as the Underwriting and Sale of SDG Bonds

Daiwa Securities Group is promoting sustainable finance to support measures intended for global decarbonization and the solution of various social issues. A vast amount of funding is needed to address climate change and other social issues existing in this modern society, and public-private collaboration is essential to meet this requirement. Based on this recognition, we are promoting sustainable finance toward the realization of a sustainable society.

Adding SDGs elements to our core fundraising support business will help us find new business opportunities and provide more value to our customers. As a pioneer for SDG bonds in Japan (including conventional Impact Investment bonds), we are providing customers with opportunities to invest in bonds issued by a range of entities for the purpose of solving social issues. We will continue to advance sustainable finance and offer more diverse products for sustainability going forward.

| Issuers | Use of funds | Sales amount (estimate) |

|---|---|---|

| Tokyo Tatemono | Sustainability bond | ¥10 billion |

| City of Kobe* | SDG bond | ¥500 million |

| Hyogo Prefecture* | Green bond | ¥200 million |

| Saitama Prefecture* | Sustainability bond | ¥660 million |

| Yamaguchi Financial Group* | Green bond | ¥11 billion |

| Sendai City* | Green bond | ¥250 million |

| Kitakyushu City* | Sustainability bond | ¥190 million |

| Nagoya City* | SDG bond | ¥400 million |

| Tokyu* | Green bond | ¥1.5 billion |

| Kawasaki City* | Green bond | ¥300 million |

| Japan International Cooperation Agency* | Sustainability bond | ¥1.5 billion |

- *Sold by multiple companies including Daiwa Securities (the sales amounts shown above are those underwritten by Daiwa Securities).

Comprehensive Asset Consulting Service

In the advent of the 100-year lifespan era, people's life plans are becoming more diversified and complex. In order to support each customer in achieving their respective life targets and making their dreams come true, Daiwa Securities has introduced the "Asset Inheritance Planning" and "Asset Management Planning" comprehensive asset consultation service, which will be provided from a medium- to long-term viewpoint.

- Asset Inheritance Planning Service

Based on the size of each customer's assets and their wishes regarding estate planning, Daiwa Securities conducts inheritance tax simulations to identify issues to be solved and propose solutions for smooth inheritance. - Asset Management Planning Service

By using highly reputed asset management tools with a proven track record, Daiwa Securities proposes optimal solutions to assist customers in all aspects of asset management, including analyzing their financial assets and helping them make investment decisions.

Moreover, Daiwa Securities in March 2024 was the first in Japan to introduce ESG- and SDGs-orientated analysis in the Asset Management Planning Service. Users can use this tool to analyze companies in light of the following four sustainability-related perspectives to make better investment decisions and improve their medium- to long-term investment performance.

| ESG rating | Analysis and rating of ESG measures and risk management on a seven-point scale (AAA to CCC) |

|---|---|

| Global warming stress test | Analysis of how the portfolio asset value may change if the global average temperature rises by 2°C |

| Prediction of temperature rise | Analysis to show the rise in temperature if global carbon emissions matched those produced by the investment portfolio |

| SDGs-related measures | Evaluation of each brand against the 17 Sustainable Development Goals |

ESG Funds

ESG funds are investment trusts that place an emphasis on environment, social and governance (ESG) factors and sustainability factors when selecting companies to invest in, including companies that are working to achieve ESG and SDG targets toward a sustainable society.

By investing in these trust funds in the financial market, investors can indirectly supply funds to companies and others that are actively working on sustainability, thereby contributing to the realization of a sustainable society on a long-term basis.

We are expanding our product lineup to meet diverse customer needs.

Initiatives in Funds for Decarbonization (Daiwa Asset Management)

Daiwa Asset Management has established and manages a carbon neutral technology equity fund (nicknamed "Carbon ZERO"). The fund invests primarily in solution companies that contribute to a decarbonized society from among global equities. Candriam S.C.A., which provides investment advice, aims to achieve zero carbon as a fund by contributing a portion of the fees earned from fund advice to green projects aimed at reducing CO2. The fund's ESG information is disclosed in its Impact Report.

Daiwa Asset Management and some of its sales companies, including Daiwa Securities, donate a portion of trust fees to tree-planting activities in Japan through NPOs. In 2024, a total of 5,425 trees were planted at three locations in Japan through the activities, and the cumulative total number of trees planted reached 21,529. Also, the number of tree planting locations has been increased to six In this way, we create opportunities to walk together with the beneficiaries toward a decarbonized society.

Further, in 2022, the fund received the Governor's Special Prize for Green Finance in the ESG Investment Category of Tokyo Financial Award 2021.

Subsequently in February 2024, Daiwa Asset Management became a co-recipient with Candriam of the bronze prize at the fifth ESG Finance Awards Japan (investors division).

Initiatives of Fund Wrap Services

In the era of living 100 years, managing assets for the medium to long term is critical. Daiwa Fund Wrap is a service that enables customers with no investment experience or too busy to make investment decisions themselves to start long-term diversified investment by having Daiwa Securities invest in and manage assets on their behalf under a discretionary investment agreement. In providing our services, we strive to communicate closely with our customers to build a relationship of trust.

To make its know-how available to a broader base of customers, Daiwa Securities' fund wrap products are also sold by its business partners, including Japan Post Bank, Shinkin banks and local banks.

To keep attracting customers over the long term, we will continue our initiatives to implement better structures and systems so as to improve our performance and the quality of our services.

- Balance of domestic Wrap accounts: ¥21,336.9 billion (As of March 31, 2025)

- *Source: Data released by the Japan Investment Advisers Association

- Balance of Wrap accounts at Daiwa Securities: ¥4,686.4 billion (As of March 31, 2025)

- *Source: Data released by the Japan Investment Advisers Association

- Daiwa Social Contribution Wrap - Daiwa Fund Wrap with a donation service

Amount donated in FY2024: ¥42.17 million (cumulative donations in the last 3 years: ¥77.07 million yen)- *Total donated amount from customers and from Daiwa Securities

- *Donated to: Food aid (UN WFP), medical care (Doctors Without Borders Japan), child support (Japan Committee for UNICEF), environment (WWF Japan), and disaster recovery (Japan Platform)

Initiatives for Solutions Business

Recently, in order to meet the needs of customers who are faced with more diverse and difficult issues, we have been increasingly required to conduct solutions business beyond the provision of conventional financial products and services, Specifically, for SMEs and other corporate customers, we need to make comprehensive proposals that help them increase their corporate value, including proposals related to business succession, M&A and management support in addition to those on fundraising and financial strategies. Also, for individual customers, we need to meet their demand for attentive consulting services, including for inheritance and lifetime gifting. Going forward, we will continue to respond appropriately to changes in the business environment to deliver customer-oriented solutions.

Workplace Business Initiative

(Effective Use of DAIWA LIFEPLAN and D-Port)

In the workplace business, DAIWA LIFEPLAN is offered as a support tool for customers building assets. Its aim is to realize a prosperous era of the 100-year life.

The service enables customers to centrally manage their stock-based employee benefit plans (such as stock ownership plans, workplace NISA, and defined contribution pension plans) and stock-based compensation plans (such as specified transfer-restricted stock (RS) and stock options) on a single online platform. The service enables us to support asset-building to help our customers realize their life plans and to actively encourage participation in a company's employee benefit plans, such as stock ownership plans and installment-type investment plans.

Utilizing the latest technologies in the context of digital transformation (DX), for companies and their employees, we are working to build highly flexible coordination based on an application programming interface (API), to provide a high degree of convenience, such as making use of cloud services to make opening accounts more effortless and less time-consuming, and to completely eliminate the need for paper and personal seals in various procedures.

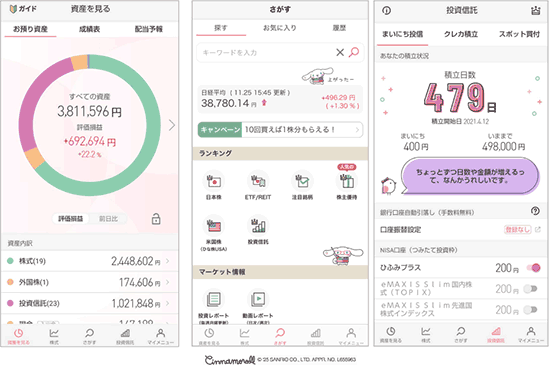

Moreover, we have introduced the D-Port asset management & investment support app, which users can easily and safely log in to by biometric authentication to check their assets. Users can also smoothly access DAIWA LIFEPLAN through the app. We are thus providing them with more convenience and are planning to enhance the provision of education on investment through the app, thereby helping users improve their financial literacy.

Expansion of Services for Asset-Building Customers through Smartphone-only Securities Company, "Daiwa Connect Securities"

Smartphones and other technical innovations are changing the common perception that securities companies are used only by affluent customers and that securities transactions require an advanced level of financial knowledge. We recognize that generating securities services available to all people in consideration of financial inclusion is an issue facing not only Daiwa Securities Group but also the securities industry as a whole.

Daiwa Connect Securities, which launched its services in July 2020, is a new type of securities company established by the Daiwa Securities Group. It features services that allow everything from account opening to securities trading and asset management to be completed via smartphone and allows beginners to start investing with small amounts easily.

Daiwa Connect Securities also partners with external companies to provide a game app that allows people to learn about investing in a fun way, a reward point investment service that allows people to use the reward points they earn from other services to invest, and a credit card regular investment service where cardmembers pay for their investments by credit card, allowing them to earn reward points from card use. These services provide opportunities to easily learn financial literacy with a small amount of money and diversify access to financial services. The company also provides teenagers with educational support for autonomous asset formation by offering "teen accounts" (for minors only).

In September 2024 Daiwa Connect Securities adopted Cinnamoroll of Sanrio Company, Ltd. as its mascot, expecting that it will help raise the awareness of the company's financial services among people, and has since been using the mascot on its website and trading app.

Daiwa Connect Securities will continue to develop and provide its services so that all people will be able to access better financial services.

Initiatives Using REITs, Funds and Other Structures to Solve Social Issues

Investment in Healthcare Facilities

Daiwa Real Estate Asset Management managed Nippon Healthcare Investment Corporation, which was Japan's first REIT focusing on healthcare facilities. On April 1, 2020, that REIT was merged with Japan Rental Housing Investments Inc., a REIT focusing on housing that was also managed by Daiwa Real Estate Asset Management, and Daiwa Securities Living Investment Corporation ("DLI"), the J-REIT with the largest amount of healthcare facility assets under management in Japan, was established. DLI invests in prime healthcare facilities that are likely to see stronger demand from society over the medium to long term as the population continues to age. Through such investment, it will contribute to the "Achievement of Good Health and Longevity," a priority issue in Japan identified in the SDGs Implementation Guiding Principles formulated by the government's SDGs Promotion Headquarters.

DLI has also established a social finance framework to provide ESG investment opportunities to investors through social financing and received a Social 1 (F) rating, the highest rating, from Japan Credit Rating Agency, Ltd. (JCR). Based on this framework, DLI has borrowed ¥10.92 billion through a social loan as of March 2025 and issued ¥2.0 billion of social bonds in January 2022, using the funds raised to acquire healthcare facilities.

Total amount of investment in healthcare facilities

- Approximately ¥110.1 billion (as of March 31, 2025)

Investment in Renewable Energy

With regard to infrastructure assets, Daiwa Real Estate Asset Management has been entrusted with the operation of photovoltaic power stations since FY2014, and since FY2017, the company has also been entrusted with the management of a biomass power generation plant invested in by Daiwa Energy & Infrastructure. Moreover, in September 2021, the company was entrusted with management of DSREF Amaterasu Core Fund, Investment Limited Partnership, a private fund targeting investment in a solar power project which was established by soliciting investments from domestic institutional investors. Further, in January 2025, the company was entrusted with the management of an energy storage facility, which is expected to help stabilize the supply of renewable energy on a long-term basis. The company will continue to expand the balance of its assets under management while striving to accumulate knowledge of investment and management in the renewable energy field.

Investment in Data Centers

Since May 2025, Daiwa Real Estate Asset Management has been entrusted with the management of data centers. Recently, AI- and cloud-based services have been widely used by a range of industries and governmental agencies, and the company is contributing to the solution of social issues by supporting DX infrastructure. It is responding to a range of social needs, such as those for remote medical services, online education and flexible work styles, for the elimination of regional disparities and higher productivity. The company will continue to work for the improvement of data centers, which support the digitalization of the entire society, through the management of funds and others.

Management results of renewable energy power plants

- Number of deals: 31

(Hokkaido, Tohoku, Hokuriku, Kanto, Chubu, Kansai, Chugoku, and Shikoku regions) - Output: Approximately 294 MW from solar power plants (excluding output from assets on land with leasehold interest), 20 MW from biomass power plants

- Annual energy output (April 2024 to March 2025):

329,054 kWh at solar power generation facilities and 133,947 kWh at biomass power generation facilities

(Assumed CO2 reduction of 179,722 t-CO2, calculated using emission factors of each regional electric utility) - Balance of assets under management: Approximately ¥108.7 billion

Management results of energy storage facilities

- Number of deals: 2

(Hokkaido and Kyushu) - Output, capacity (planned): Output of 63 MW and capacity of 260MWh

- Balance of assets under management (planned): ¥12.8 billion for total assets such as energy storage equipment

FY2024 Initiatives Taken by the Group's Overseas Offices

Daiwa Capital Markets Europe Limited (DCMA) Underwrites the International Finance Corporation's AUD 700 Million Benchmark Bond for Biodiversity Conservation

In November 2024, DCME helped the International Finance Corporation (IFC) issue an AUD 700 million 10-year benchmark bond for biodiversity conservation as the lead manager for the issuance of the bond. The IFC is a member of the World Bank Group and the world's largest international organization that specializes in the development of the private sectors of developing countries. The IFC is contributing to economic development and higher living standards of people by investing in and giving advice to companies in the private sector. The funds raised by the issuance of the bond will be utilized for biodiversity conservation initiatives, including BTG Pactual Timberland Investment Group's Latin American reforestation strategy (that focuses on reforestation and forest conservation in selected areas) and the world's first biodiversity bond (issued for the purpose of restoring natural forests in Colombia) by BBVA Colombia.

Holding Japan-Australia Deep Tech Forum Jointly with the Australian Embassy in Japan

In December 2024 Daiwa Securities held the Japan-Australia Deep Tech Forum jointly with the Australian Embassy in Japan on the premises of the Embassy. About 100 people participated in the event, including from Main Sequence Ventures, which is the Australian government's VC fund in which Daiwa Securities Group invested in 2023 and its investee startups, as well as the Australian Ambassador to Japan, officials of the Japanese Ministry of Economy, Trade and Industry, and representatives from JAFCO, Incubate Fund and SPARX, which are leading Japanese VC funds. Staff from UTokyo Innovation Platform (UTokyo IPC), Kyoto University Innovation Capital (Kyoto iCAP) and WASEDA University Ventures (WUV) also participated in the forum. They discussed the trends of Japanese and Australian startups and innovations and the possibilities of Japan-Australia collaboration in the fields of decarbonization, medial treatment, food and space. Daiwa Capital Markets Australia is promoting Japan-Australia collaboration in the field of innovation, which can contribute to the solution of social issues.

Providing Analysis/Proposals on the Economy, Society, and Investment Information

Daiwa Securities Group as an integrated securities group provides, in addition to investment information, a wide range of information on the economy and society. We hope that the measures we propose from a long-term perspective will be helpful to customers, investors and a variety of stakeholders.

Initiatives to Provide Information on ESG (Daiwa Securities)

Daiwa Securities' Equity Research Department is a group of analysts and strategists. They analyze and evaluate information released by companies, and provide stock price information and investment strategies and ideas to institutional investors (such as asset management companies, banks, insurance companies, pension funds).

International agendas, such as the SDGs and the Paris Agreement, have gained much attention in recent years. Driven by this trend, a growing number of investors are using nonfinancial information in relation to the environment, society, and corporate governance when making medium to long term investment decisions. Therefore, the ESG Research Section, which specializes in handling ESG information, within the Equity Research Department has put in place a system for comprehensively analyzing and evaluating financial and nonfinancial information. The ESG Research Section works on writing analysis reports focusing on topics such as climate change, human rights and gender issues, corporate governance systems, and social impact, as well as holding ESG seminars and other activities.

ESG information will become more and more important for companies and society as a whole for achieving sustainable growth over the long term. We strive to provide appropriate ESG information in a timely manner so that institutional investors will be able to expand their investment returns in the medium to long term through responsible investment and purposeful dialogue (engagement).

The Fixed Income, Currency and Commodities (FICC) Research Dept. is working to meet the information needs of institutional investors, including trends in the SDG bond market, climate change and bond markets, and ESG investment performance, with a focus on bonds and interest rates.

Comprehensive Provision of Information and Policy Proposal Activities

Daiwa Institute of Research (DIR), which assumes the think-tank role of Daiwa Securities Group, provides wide-ranging analysis and information to the public. At DIR, we consider it our mission to engage in comprehensive provision of information and policy proposal activities concerning the financial and capital markets and the real economy. We have always sought to provide up-to-date and in-depth information and a unique viewpoint that has not been presented by others. In order to provide information that satisfies the needs of the public, we also exchange information and hold discussions with businesses, investors, public institutions including governments and municipalities, and various economic groups, as well as overseas think-tanks and media. In this way, we are able to analyze the currents and trends of society and disseminate information.

We also actively deliver sustainability-related information, with the ESG Research Section of the Financial Research Department playing a central role in researching, analyzing, and disseminating related information. In recent years, sustainability disclosure frameworks have evolved rapidly worldwide, with growing interest from both issuers and investors. In FY2024, the Section published 50 reports related to the SDGs and ESG and visited 169 financial companies and business companies to provide SDG/ESG information.

Provision of information by DIR through diverse media

- Number of reports posted on the website: 476 reports (Results for FY2024)

- Full texts of reports available on the website

- Number of recent hits on the research division's page: 2.34million hits (Results for FY2024)

The DIR Research Division conducts a wide range of information dissemination activities, including reports, media appearances, and book publications. The Research Division provides clear explanations of complex economic and social issues and produces high-quality reports, which has increased opportunities to communicate with clients.